So you’ve decided you want to buy some bitcoin, but you want the lowest fees. Making your first purchase might feel like a daunting experience, but with a little guidance, it can be simple and fun. This guide breaks down the cheapest ways to buy bitcoin – the companies that will give you the lowest fees and a great buying experience.

Where can I buy bitcoin with low fees?

There are two ways to buy bitcoin: on an exchange or through a broker. Typically exchanges are more complicated to use, but offer lower total fees. Brokers provide an extremely easy to use interface and a lot of education along the way to help you understand why you might want to hold on to your bitcoin.

Beware of exchanges that offer low trading fees while hitting you with high withdrawal fees. These might end up being more costly when you end up taking your bitcoin off the exchange, to hold on your own wallet. This is what I do! You can Google an exchange’s name followed by “fees” to find more information about their fees on the exchange’s website. Search that page for withdraw fees.

On to brokers – the simplest way to buy bitcoin.

Buying Bitcoin Through a Broker with Low Fees

Brokers give you a simple interface to buy bitcoin, as easy as buying something from Amazon. No messing around with complexities of exchanges like order books and price charts; just hit Buy.

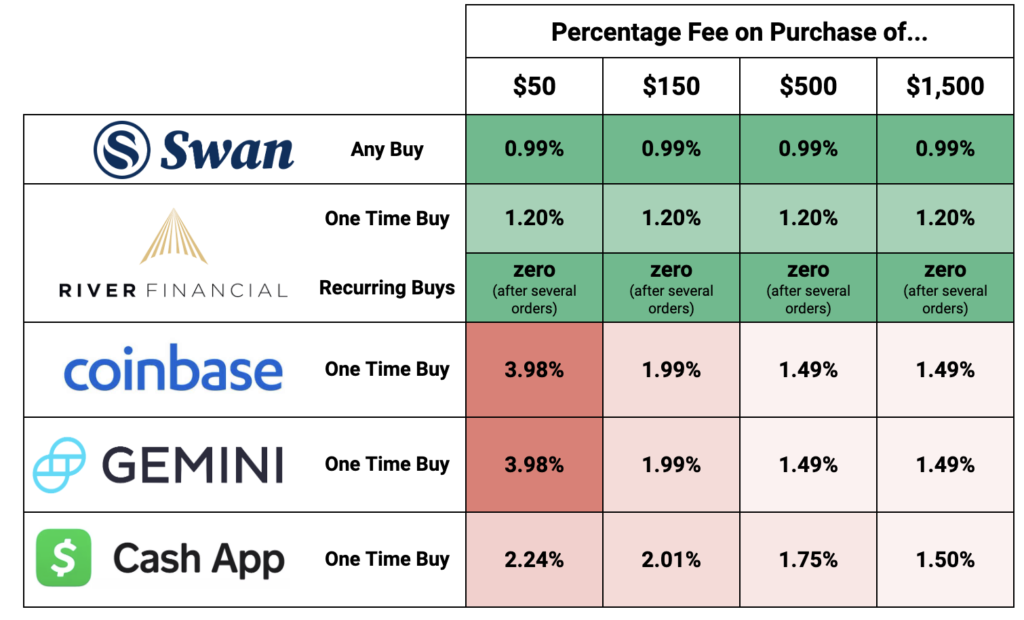

In this fee table, we cover the fees for immediate purchases of bitcoin using a bank account. Brokers may also charge what is called a ‘spread’ on top of this fee. We can’t tell you what the spread is, because it varies for each individual purchase.

Check out the table below: the greener the cell, the cheaper the fee! More information on each broker, including referral links with free bitcoin, can be found in a table below the fee information.

| Tool | Availability | Fee Info | Sign Up |

|---|---|---|---|

| All US residents except NY, HI, SD | Swan | Earn $10 in free bitcoin |

| All US residents except NY, NV | River | Earn $5 in free bitcoin |

| This list of countries | Coinbase | Earn $10 in free bitcoin |

| This list of countries | Gemini | Earn $10 in free bitcoin |

| All US residents | Cash App | Earn $5 – use code JSVLDBF |

Buying Bitcoin on an Exchange with the Lowest Fees

Using an exchange to buy bitcoin requires a bit of technical knowledge on how to submit orders and read charts, but it’s often the cheapest way to buy bitcoin if you’re willing to learn.

Below we cover the maker and taker order fees for several of the top exchanges. A maker order is where you set the price at which you’re willing to buy or sell, whereas a taker order is one in which you take the best offer that other traders have for a buy or sell. For these exchanges, order size does not matter much for fees unless you are trading a lot – like more than $10,000 per month!

| Exchange | Maker Fee | Taker Fee | Full Fee Table |

|---|---|---|---|

| Kraken | 0.16% | 0.26% | Kraken |

| Coinbase Pro | 0.4% | 0.6% | Coinbase Pro |

| Gemini (ActiveTrader™) | 0.2% | 0.4% | Gemini |

| Bitstamp* | 0.3% * | 0.4% * | Bitstamp |

What will I need to complete my purchase?

For any of the methods above, you will need a bank account or debit card and a national or state ID. The broker or exchange will use your ID to complete a mandatory identity verification or ‘KYC’ (‘Know Your Customer’) check. This is a legal requirement made by governments which all exchanges, brokers, and banks must follow to stay in business.

What can I do with my bitcoin after I purchase it?

You can use your bitcoin to pay for goods and services, or simply hold on to it. You can also withdraw your bitcoin from the exchange or broker and hold it yourself. When holding your own bitcoin, your are responsible for its security – however, no exchange hack or bankruptcy will affect your holdings!

There are many ways to store bitcoin – on your phone, your computer, or on a dedicated device called a hardware wallet. Here’s a good overview of options for bitcoin wallets to store your bitcoin.

We cannot stress enough how important it is to be able to withdraw your bitcoin from your exchange. Bitcoin is a new type of asset, more like a gold coin than a stock. When you buy stocks, there are digital records recording your ownership – but you don’t own those records, which makes them easy to confiscate should a government or other powerful entity believe you’re not worthy of owning that asset anymore. However, bitcoin is like a bar of digital gold – you can hold it yourself, without any need to trust a third party like an exchange to protect it for you. If you withdraw your bitcoin from the exchange, you are no longer at risk of losing your bitcoin due to incompetence or malpractice by the exchange.

Don’t underestimate the risks of seizure of bitcoin held on exchanges. Theft of hard assets by governments from their citizens has even happened in countries with a strong rule of law: the US government forcefully seized gold from citizens through Executive Order 6102. This was signed a few years after the start of the Great Depression and ordered the mass confiscation of gold held by citizens.

You eliminate much of this “third party custodian” risk when you withdraw your bitcoin from the exchange to a wallet you control on your phone or computer. While popular apps like Robinhood and eToro allow you to buy bitcoin, we chose not to discuss them here because they do not support your ability to withdraw your own bitcoin – and we think that’s wrong!

What is the ‘withdrawal fee’ for Bitcoin on exchanges like Bitstamp?

Many exchanges and brokers, including Bitstamp and River Financial, will charge you a withdrawal fee when you take your bitcoin out of the exchange. This is similar to an ATM fee – a flat charge for taking your bitcoin from the exchange and in to your own wallet.

This fee is usually dynamic, and is a market price based on the competition between the decentralized network of bitcoin miners to include your transaction in a ‘block’ of Bitcoin transactions. Here’s a visualization of fees in US dollars from YCharts. You can think of your and your exchange as buyers of a piece of the finite space within a Bitcoin block, while miners are sellers of that block space. You want to get the best price, and all miners are competing against each other to serve you!

The Bitstamp withdrawal fee is a set amount, not dependent on demand for block space – you can find that fee posted here under “Crypto Deposits & Withdrawals”. Don’t mistake BCH (Bitcoin Cash, a failing fork of Bitcoin) for Bitcoin (BTC) on this page! River Financial has a dynamic withdrawal fee – more details here.

What is the ‘spread’ when I buy bitcoin with a broker?

The ‘spread’ is an additional fee that brokers will add to their percentage fee that represents the difference between the price they buy the bitcoin for you from the price they sell it to you. Stock brokers charge a spread as well, especially ‘no fee’ platforms like Robinhood. Here’s an example to make the ‘spread’ more clear:

You want to buy 1 bitcoin, and you see that the average price that all major exchanges are selling 1 bitcoin at is $19,000. You set up your purchase on Coinbase, and see that the price they are selling you your 1 bitcoin at is $19041! This $41 difference in the market price and the price the broker gives you is the spread the broker is taking as an additional fee.

Should I buy other cryptocurrencies?

Some services will try to sell you other ‘cryptos’ – don’t fall for this! Other cryptocurrencies lack the level of assurances of security and the network effect of Bitcoin. Do your own research to better understand their promises and how their system works, as well as Bitcoin’s network. Start here.

If you like my work, please share it with your friends and family. My goal is to provide everyone a window into economics and how it affects their lives.

Subscribe to email updates when new posts are published.

All content on WhatIsMoney.info is published in accordance with our Editorial Policy.