Over just the last two decades, the United States greatly increased the supply of dollars by lowering interest rates and bailing out corporations through quantitative easing – all of which should cause price inflation. Inflation in the US, however, is still low while many other nations around the world with economies closely tied to the dollar are suffering from high or hyper-inflation in their prices. I did some reading on this topic to better understand how the United States might be ‘exporting’ its inflation to other countries.

When the supply of US dollars increases, imports to the US become more expensive. Many developing economies need to sell to the massive US consumer market, so these countries must devalue their own currencies to stay competitive. This causes inflation in developing economies.

The United States government has many reasons for increasing the supply of dollars, including reducing their debt burden and funding the growing deficit of the federal government. However, the dependence of many developing nations on the United States consumer market and food production means the supply of dollars in the world can have major economic and humanitarian ramifications.

Inflation: The Biggest Export of the United States?

The United States is in a privileged position given that it holds the tools necessary to control the supply of dollars circulating in the world. It is also the biggest consumer market in the world, which means most developing economies rely on American buyers to drive their economic growth. These two conditions make for a dangerous combination – the US can produce dollars and send them abroad for goods and services, thus pushing inflation on to other countries.

Here’s how this works, broken down into simple steps:

- The US Federal Reserve lowers interest rates or creates dollars through quantitative easing – both of which are aimed at increasing the total supply of dollars in the world.

- The Fed’s actions allow cheaper dollar credit to be accessed by the US Federal Government, US companies, and those with connections to American banks. When this credit is used by taking out loans, new dollars are created.

- Those who receive new dollars spend them – often on imports to the US – and the extra dollars end up circulating in foreign countries.

- Now, foreign countries are flooded with new dollars and their governments face a choice:

- Let their own currency appreciate in value against the dollar, which would reduce the country’s competitiveness in the world market and decrease their exports.

- Create more of their own currency to stabilize its value against the dollar and retain competitiveness on the world market. However, this causes price inflation for their citizens and makes imports more expensive.

Many developing countries are dependent on cheap exports in order to keep their economy growing, so they cannot let their own currency appreciate. However, if they create too much of their own currency they risk setting off rampant inflation and increased import prices. Individuals choosing to hold US dollars instead of local currency in times of crisis also push down the value of the local currency, causing price inflation.

The US benefits from increasing the supply of dollars because they are able to purchase more goods from abroad with newly printed money. Americans receive valuable goods while foreign countries receive a currency that can be cheaply printed and distributed by the US government and banks.

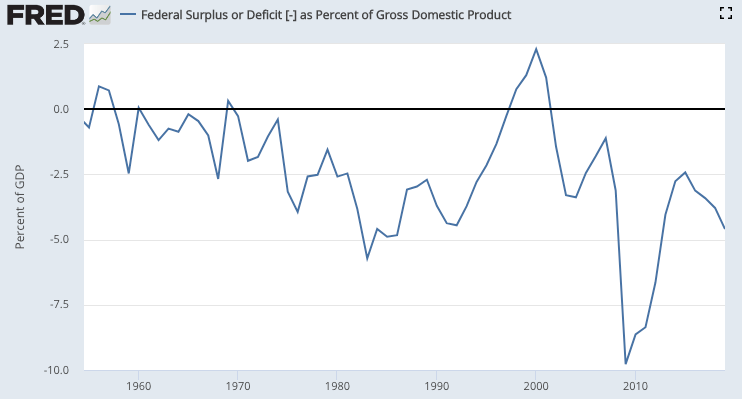

Over time, this behavior of constantly increasing the supply of dollars to pay for things has normalized among the American public and government, leading to ever lower interest rates (aka cost of credit, or loans) and larger budget deficits by the federal government.

The Federal Deficit is growing larger, even as a percentage of the growing US gross domestic product.

Exporting Inflation to Egypt after the 2008 Financial Crisis

Egypt is one example of a country that saw rising inflation following the unprecedented new dollar creation and zero interest rate policy of the US Federal Reserve following the 2008 financial crisis. According to the World Bank, Egypt’s annual inflation rate fell from the mid-1980s until it began rising sharply in the late 2000s, with a huge increase in 2008 when inflation doubled from the prior year.

This loss of value in the Egyptian currency, the Egyptian Pound, helped exports remain competitive in the world market but made imports more expensive. This was a huge problem for Egypt, as well as many other Middle Eastern nations, because over the past half century they had become increasingly reliant on imports for food supply. High prices for basic food staples like grain led to social unrest in 2010 and 2011 across many Middle Eastern states, which many termed the Arab Spring.

How are imports and exports affected by currency values?

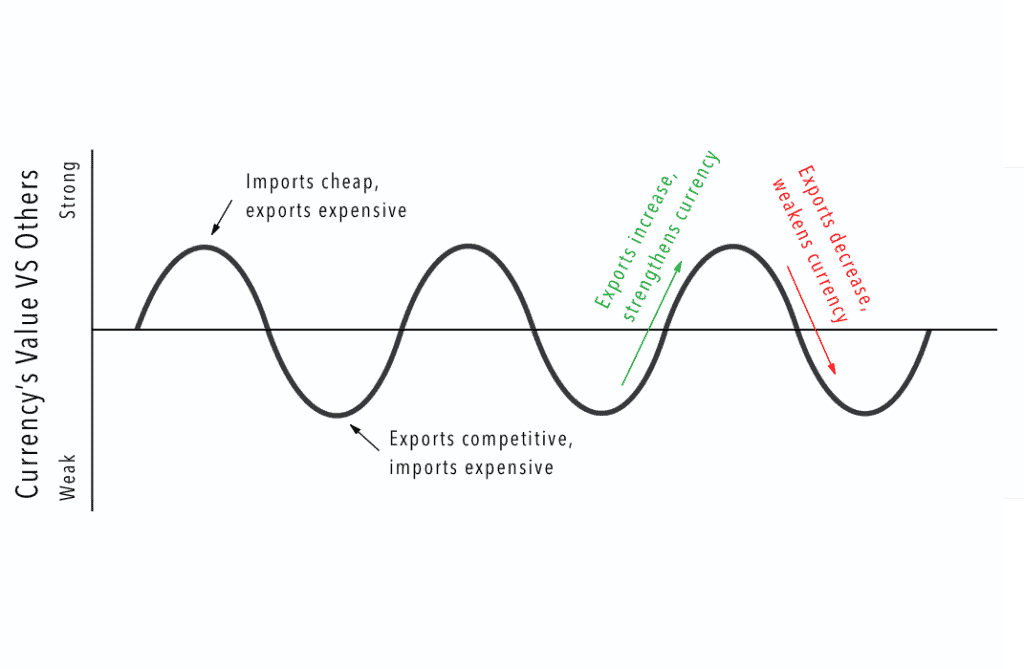

Currency values and the ratio of imports to exports are engaged in a constant feedback loop. When a country imports more value than it exports, this usually puts downward pressure on the value of that country’s currency. The importers are effectively selling their own currency in exchange for foreign goods.

When imports exceed exports, the importers are doing this more than the exporters are selling goods in exchange for their own currency from foreigners. More selling of the nation’s currency means the value goes down.

A lower value currency makes the goods of this country cheaper to foreign buyers, which puts pressure on exports to increase and imports to decrease. The trade balance thus flows in a cycle – when imports exceed exports, the decrease in the value of the nation’s currency pushes them back in line. The same mechanics operate in reverse when a country exports more than it imports.

However, because many central banks have independent monetary policies, this causation can happen in reverse – meaning the currency value itself can change the ratio of imports and exports. Say a country exports more than it imports in goods, which usually strengthens the currency.

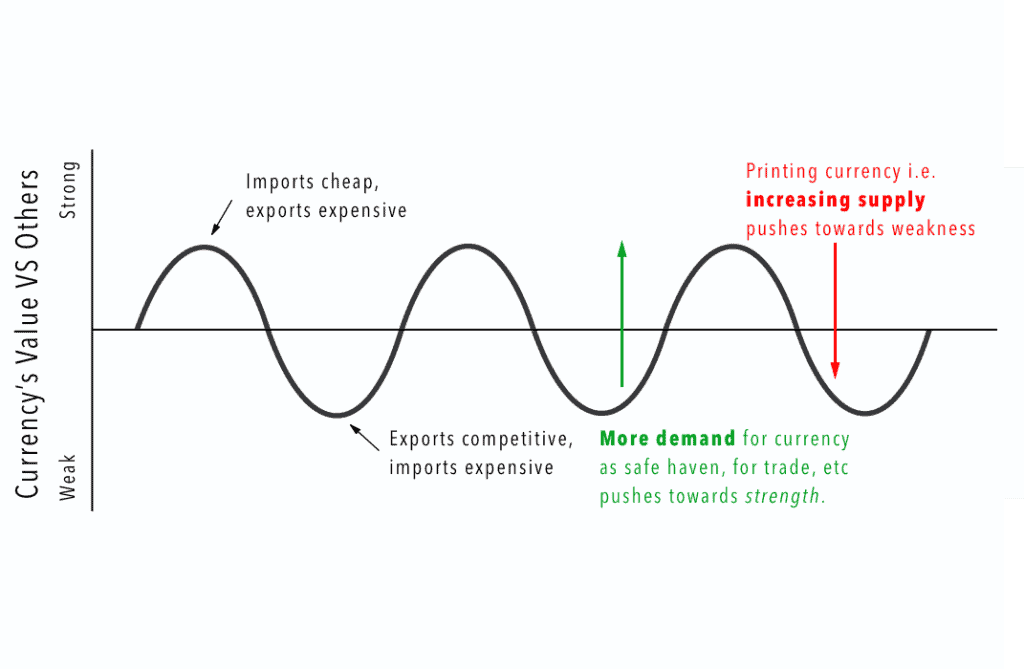

A stronger currency would make exports more expensive to foreign buyers, and thus dampen exports and increase imports. However, if that country’s central bank increases the supply of their own currency, they may be able to weaken it enough to keep their exports cheap for foreign buyers – or ‘competitive in the foreign market’ as economists would say.

The US is in a unique situation because the prevalence of the US dollar in international trade keeps it in high demand. As long as the dollar is in high demand internationally, the US can continue to have high imports and low exports without the currency depreciating drastically. The US can even increase the supply of dollars to fund social programs, defense spending, and bank bailouts without a massive hit to the dollar’s value versus other currencies.

Through international trade conducted in dollars, the US effectively exports their dollars abroad, leading to inflation in foreign countries and a net inflow of goods to the US. This is good for the US consumer, at the long-term expense of the countries which export to the US.

For a historical and simplified example of what is happening today between the US and trading partners, see the story of the aggry beads in the What is Money? post.

How did the US dollar become so important in international trade?

Several key events over the past century helped the dollar gain dominance in international trade, beginning with the conclusion of World War II and the new Bretton Woods monetary system.

As a victor in WWII and one of the world’s largest and fastest growing economies, the US was able to convince many nations to peg their currencies to the US dollar, with the dollar then pegged to gold at a rate of $35 to one ounce of gold. Prior to WWII, most of the world’s currencies were simply representations of gold, a scarce commodity that had served as money for millennia in human civilizations.

This move tied the entire world economy to the fate of the dollar. However, the United States did not keep its promise to peg $35 to one ounce of gold, and instead printed more dollars than they had gold to back. They used these dollars to fund social programs and war spending during the 1950s and 60s. By 1971, the dollar was backed by gold at closer to a rate of $200 to one ounce of gold, and Nixon shocked the world by taking the US dollar off of the ‘gold standard’.

Since then, the US has used its soft power – diplomacy, deals, coups, and possibly even wars to ensure that the dollar is steadily demanded internationally. It is nations that attempt to throw off the dollar’s dominance in world trade that are subject to sanctions and tariffs.

Protecting yourself from inflation is one of the core goals of investing, but given the rapid price rise of goods around the world as of late, it’s becoming increasingly difficult to beat inflation in prices for the goods and services you need. There are alternatives built for the purpose of resisting inflation – you can read more about one alternative here.

If you like my work, please share it with your friends and family. My goal is to provide everyone a window into economics and how it affects their lives.

Subscribe to email updates when new posts are published.

All content on WhatIsMoney.info is published in accordance with our Editorial Policy.