Central banks today use a few tools to impact economies and manage cycles. However, these tools are sometimes implicated in negative changes to the economy, such as wealth redistribution, inflation, or asset bubbles.

How does this happen? In short, central banks distort natural signals given by the market which regulate prices and smooth them out over time. For example, when people and businesses borrow heavily, interest rates are pushed up, which makes borrowing more expensive – discouraging borrowing and setting things straight. Central banks distort the interest rate market to drive consumption and borrowing, but they can also distort other markets.

Quantitative easing may distort the markets for financial assets like stocks and bonds by acting as a ‘lender of last resort’ that essentially ensures the value of these assets using the power of their almighty printing press. By providing a safety net, they make these assets more attractive for investors, who flood the market with cash and drive up the value of these assets – creating a bubble.

In short, quantitative easing (or QE) by central banks such as the US Federal Reserve does drive asset bubbles – but not in the way you think. In 2008, QE saved an asset bubble from popping, which set a precedent that central banks would save investors in future ‘systemically-risky’ bubbles.

In this article, we’ll define quantitative easing and asset bubbles, then show how quantitative easing could be causing investors to get in on risky assets more than they should – causing bubbles to form.

What is quantitative easing?

Quantitative easing means a central bank buys long-term financial assets – like corporate and government bonds – from banks, corporations, and other asset holders in order to expand liquidity in times of crisis. This adds new money to the economy and makes it easier for banks and financial institutions to make investments and extend loans.

The quantitative easing tool is used by central banks when they have manipulated interest rates down to nearly zero already, and therefore cannot incentivize borrowing and investment by lowering the ‘cost of money’ (interest rate) any further. The goal of quantitative easing is the same as that of lowering the interest rate – to drive economic growth by encouraging lending and investment.

The ‘long term financial assets’ bought by central banks are often long-term government bonds (government debt) and occasionally corporate bonds or complex financial products like mortgage-backed securities. Some central banks, like the Bank of Japan, regularly buy corporate debt and even corporate equities – also known as stocks.

An ill-reported effect of quantitative easing is to keep financial asset prices high. Central banks step in to buy these assets during times of crisis, when the value of these assets would otherwise plummet. This is another way that central banks act as a ‘lender of last resort’ – when prices for assets are falling fast due to a financial crisis, the central bank steps in to buy those assets at higher prices. This is critical to preserving the existing financial system because all banks, corporations, pension funds, and even our currencies themselves are reliant on prices for financial assets staying high.

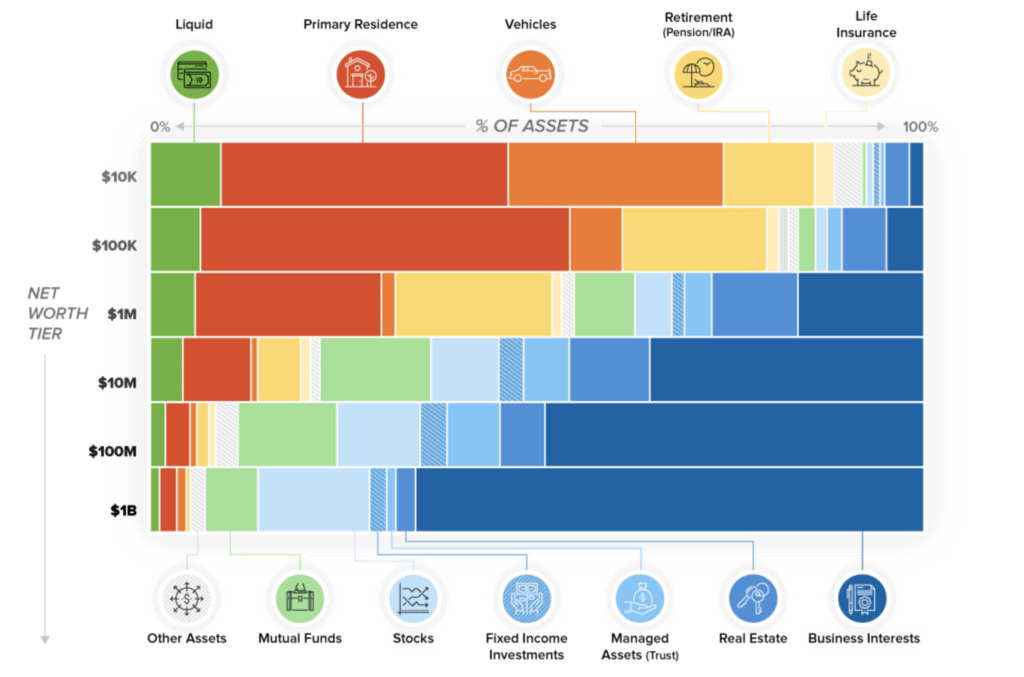

All of these entities are reliant on financial asset prices because they hold much of their wealth in these assets. They do this because central banks have pushed interest rates down so low, and created so much new cash as a result, that holding wealth in cash doesn’t make any financial sense. Savings accounts have incredibly low yields, or earnings, and cash itself loses at least 2% in value every year by design.

Therefore, if assets crash in value, banks will no longer be able to provide cash for you at the ATM by selling off some of their assets. Corporations will need to quickly sell off all their assets to raise the cash needed to pay their employees. Homeowners will no longer have the cash to pay their mortgage payments because their employer missed payroll or laid them off. The domino effect of falling asset prices will cause the entire system and everyone in it to not have enough cash to pay their debts and obligations going forward. Economists and financiers call the risk of this occurring ‘systemic risk’ and treat it as the biggest evil to be avoided.

If the system unwinds due to falling asset prices, then banks, central banks, and governments will lose the power afforded to them by their currencies and banking systems. Those who hold mainly financial assets, like the 1% and large corporations, will also lose much of their wealth. It is in the interest of these major players to make sure everyone trusts the banking system – so when people don’t have enough cash to pay their bills, they simply print more cash and put it in the system through quantitative easing.

When even quantitative easing isn’t enough to keep asset prices from falling, central banks resort to their third tool: Helicopter money. Helicopter money is a term coined by economist Milton Friedman which means handing newly printed cash directly to households from the government in the form of stimulus checks or direct deposits.

While mainstream media has done a great job of spinning the need for helicopter money as an extraordinary measure prompted by an unprecedented global pandemic, even former Federal Reserve chairman Ben Bernanke wrote in 2016 that central banks would need to resort to helicopter money the next time the financial system faced systemic risks.

Examples of Quantitative Easing

The US Federal Reserve and many other major central banks embarked on massive quantitative easing programs following the 2008 financial crisis. The Federal Reserve bought around $1 trillion in mortgage-backed securities; the Bank of England bought around 200 billion pounds of long term government debt (PDF Page 3).

Japan was one of the first governments to begin quantitative easing, when zero interest rates were not enough to jumpstart the economy in the early 2000s.

What is an asset bubble?

An asset bubble occurs when an asset’s price rises massively only to contract back down near the price where it began to rise. Many financiers also say a bubble occurs when an asset’s price begins to diverge from its ‘fundamental’ price by a large margin. This framework may be applied to assets like businesses, which are often valued based on a discounted cash flow analysis which takes into account the assets owned by the business, its cash flows, and expectations about how that business may perform in the future. The first two parts of that model have fairly well-defined methods for measurement that most investors agree upon, and for many businesses, investors have similar views on the ‘future expectations’ part as well.

For example, Warren Buffett made his wealth by buying ‘undervalued’ stocks, where he judged that the price of the stock implied that investors were undervaluing the business based on the fundamentals of the business.

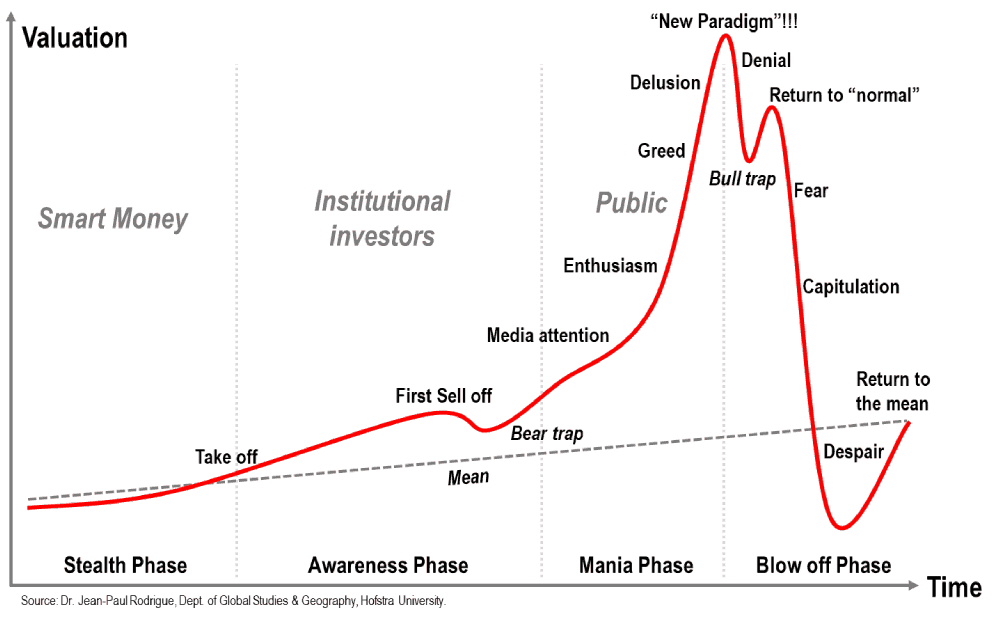

Stage 1: Jumpstart

An asset bubble often begins to inflate when a small number of investors believe the future will be very different from how others expect it, and buy up an asset that will rise in price if that future comes true. Think about Tesla investors – if you think every car on the road will be a Tesla in 20 years, or will be powered by a Tesla battery pack, you might think Tesla’s stock will be worth far more in the future than it is today.

If there are more buyers than sellers, the price of the asset jumps.

Stage 2: Boom

As the asset rises in price, other investors notice. More may buy the asset as they are convinced by the early buyers that the future they believe in will come true, and this will cause the asset’s price to jump significantly, making the buyers rich.

At this stage, there are many more buyers than sellers of the asset – the price climbs significantly.

Stage 3: Euphoria

As the asset’s price rise accelerates, more investors take notice. Some may jump in without taking a deep look at the asset and its fundamental characteristics, simply buying on ‘fear of missing out’.

This is the stage in which we see millennials armed with the Robinhood stock trading app taking bigger and bigger risks based on Reddit posts. Caution is thrown out the window as investors and speculators fear missing out on massive price gains.

Stage 4: Market Top

Investors who bought the asset in stage 1 or 2 are now sitting on huge profits, and some begin to sell their holdings. Other investors may see that the future expectations that caused them to purchase the asset no longer look probable, so they may sell. This may be true if they believed the fundamental value of the asset would rise over time to match the price of the asset in the markets, but they are not seeing this. When investors begin selling more than new investors are buying, the price starts to fall. When it falls too far, stage 5 ensues.

Some bubbles have a very identifiable ‘pin’ that pops the bubble, causing investors to change their mind about the value of the asset. For example, the 2007 mortgage crash came after a wave of homeowners could not make their mortgage payments, revealing to investors that the quality of the mortgage-backed securities which they bought was much lower than expected.

Stage 5: Panic

As investors start to see the momentum in price gains wane, those holding the asset begin to sell. Investors who were preparing to buy the asset may sit on the sidelines. The result is a collapse in demand for the asset combined with a high supply of the asset on the market. This causes the asset’s price to crash back down to what the market judges as the ‘fundamental’ value of the asset. A true bubble crashes back down to where it began, reflecting that the ‘fundamental’ value of the asset did not change – only the price did.

Examples of Asset Bubbles

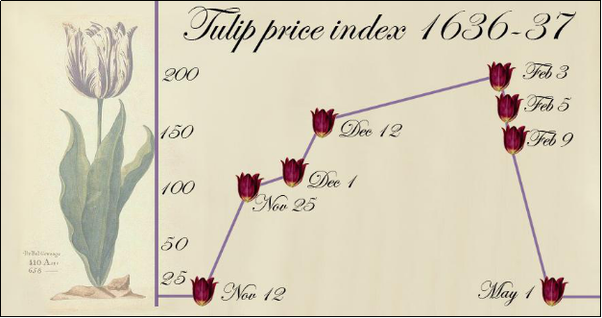

Possibly the first bubble in recorded history was in the Dutch tulip market – prized varieties of tulip bulbs, like the Viceroy Tulip, were worth several times the cost of the average home at the time.

In 2001, overinvestment in technology companies that failed to rise in underlying value at the rate their stocks appreciated came crashing down.

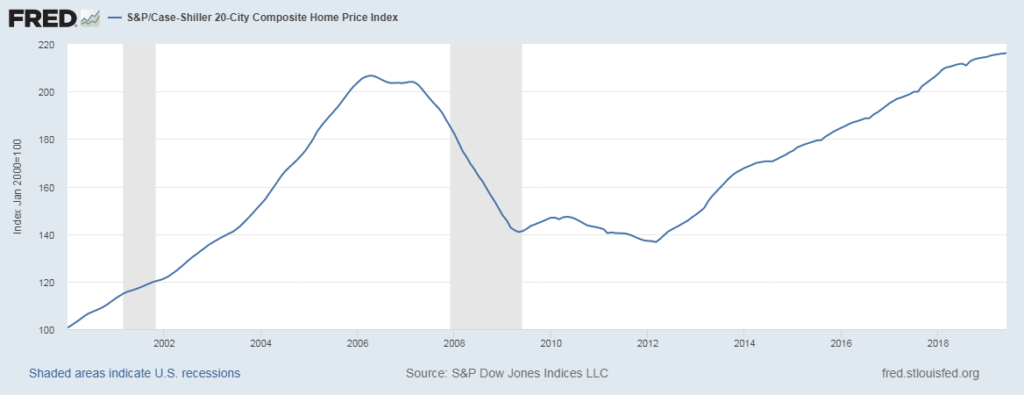

In 2007, overcomplication in financial products caused banks to over-expand credit in the real estate market, which eventually came crashing down when mortgage payments couldn’t be made by homeowners.

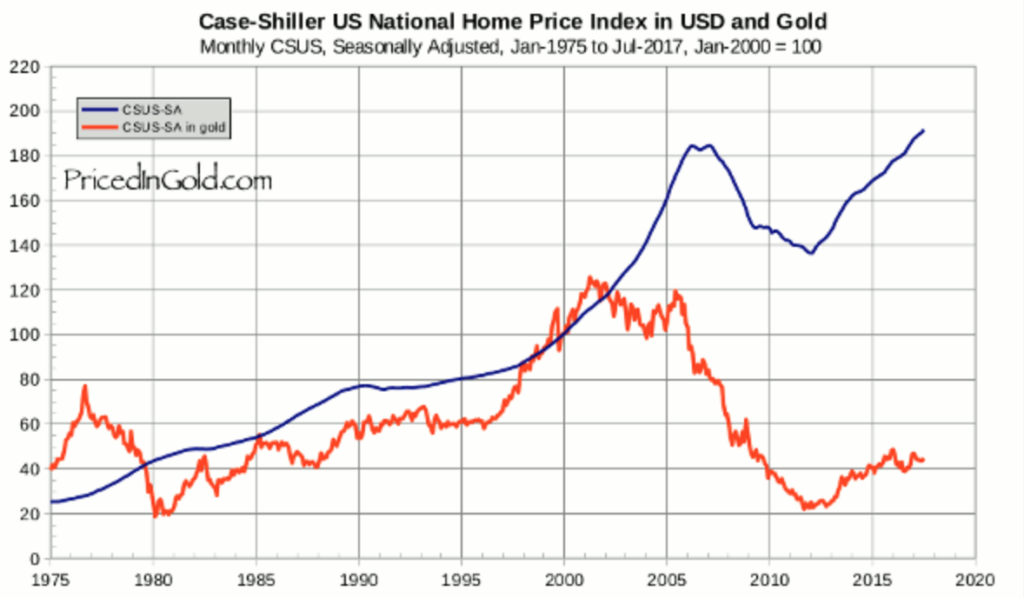

You’ll notice that the 2008 bubble, in dollar terms, landed back down higher than it started. This implies that the asset’s underlying value increased. However, because the supply of dollars and other fiat currencies can be (and is) increased by central banks, dollars aren’t a great way to measure asset bubbles.

Think of it this way: say an average home is valued at $100,000 in year 1. A bubble in home prices occurs in year 2, driving that home price up to $500,000 at its peak. When the bubble pops, the supply of money doubles as the government and central bank print cash to ensure the financial system remains solvent. The average home’s value settles at $200,000 in year 3. However, the money supply doubled, so for every $1 in year 1 there are $2 in year 3. In year 1 terms, that home is still only worth $100,000.

Therefore, measuring bubbles in terms of fiat currencies like the US dollar is equivalent to measuring your height with a measuring tape that shrinks over time. In the next section, we’ll propose a new way to measure bubbles.

What does quantitative easing have to do with asset bubbles?

Quantitative easing, in short, increases the supply of cash in the economy. Asset bubbles, in short, are an increase in the price for an asset that causes its price to diverge from some underlying consensus ‘value’ – or otherwise skyrocket absurdly in price.

To understand how quantitative easing interacts with asset bubbles, we need to look at where the newly created cash from QE goes. Follow the money, as they say.

When quantitative easing is carried out, the new cash is exchanged for debt securities held by large financial institutions and corporations. This fills these businesses with cash that the central banks hope they will use to extend loans and drive economic growth. However, these businesses are private entities, and like any other private business, they want to earn maximum revenue so they can pay employees and grow their operations.

These financial entities want to maximize the return on this cash. Holding it as cash is not very profitable, considering cash loses value to inflation. After the 2007 mortgage debacle, no bank wanted to take risks by lending to lower-income ‘subprime’ borrowers. So, banks focused on ‘safe’ investments: blue-chip stocks, corporate bonds, wealthy clients, luxury real estate, and US Treasury bonds.

In short, what we have is too much money chasing too few assets (stocks, bonds, and other investment opportunities), causing the price of these assets to rise – or in this case, stop crashing. These price rises are not explained by any increase in the underlying value of the asset, but are simply a result of increased money supply.

“Take a step back, though. A rising tide of liquidity floats many boats, but we know from experience that liquidity-fuelled asset markets usually end badly, as they did in 1974, 1987, 2000 and in 1989 in Japan.”

The Federal Reserve is the cause of the bubble in everything, January 16th 2020, Financial Times

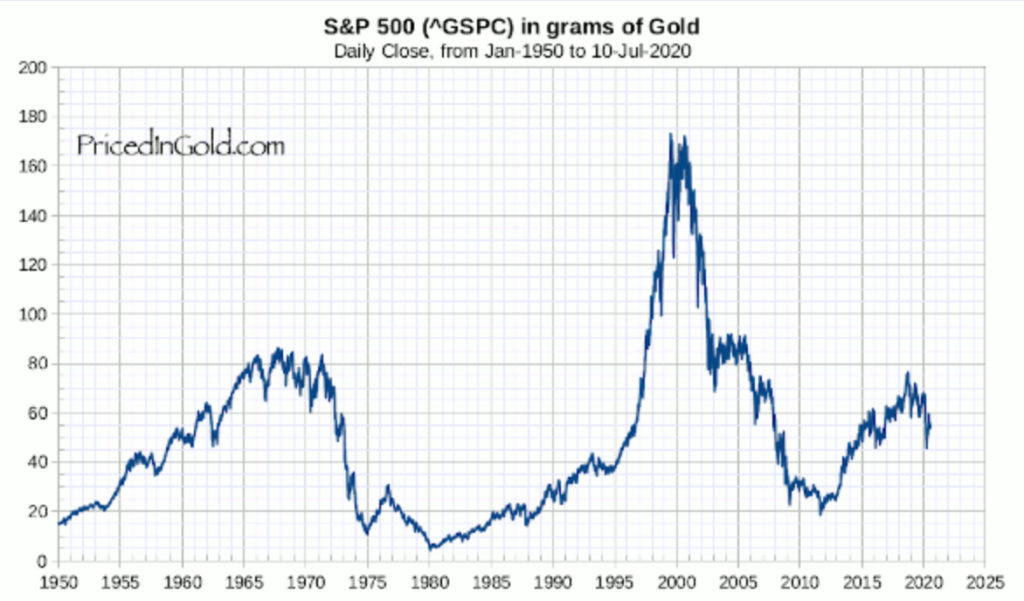

Measuring bubbles in terms of US dollars, then, gives us an inaccurate impression of the actual change in price for the asset – because the measuring stick is changing. We need to measure the price for assets in a heavily traded commodity that has very little supply changes over time – like gold.

The rounds of quantitative easing successfully halted the 2008 market crash in dollar terms, but in gold terms it did absolutely nothing. The actual values of the assets didn’t change from the 1990s to 2010, but their prices went through a significant bubble. The value didn’t change, the supply of dollars and fiat currencies did.

So what does this mean for the last 10 years?

Are we currently in a Quantitative Easing Asset Bubble?

Most of the new cash which entered the financial system after 2008 was squirreled away in bank reserves or used to purchase government debt and other ‘safe’ investments. Given that central banks stepped in to bail out the financial system and keep these asset prices afloat after 2008, financial firms and corporations held a reasonable expectation that they would do so when the next bubble popped. So they bought up these assets.

And they were right. The Fed embarked on a massive ‘unlimited QE’ program following a global pandemic which locked up global trade.

How did banks and investors respond? After an initial selloff came buy, buy, buy in the face of some of the most devastating unemployment news in the real economy of the last century.

This picture says it all:

Markets are entirely disconnected from reality.

Some may call this a fluke as a result of an unprecedented pandemic – however, financiers like Ray Dalio and journalists at Bloomberg and the Financial Times predicted this before the pandemic, for years prior. Every bubble needs a pin – this one happened to be a pandemic.

If you like my work, please share it with your friends and family. My goal is to provide everyone a window into economics and how it affects their lives.

Subscribe to email updates when new posts are published.

All content on WhatIsMoney.info is published in accordance with our Editorial Policy.