While it would be nice to have a helicopter drop money on us, the term helicopter money does mean something slightly different. While there is no real helicopter involved, there is new currency involved – but not for free.

Helicopter money refers to giving central bank money (like Dollars, Euros, or Yen) directly to regular citizens, similar to a universal basic income. Helicopter money is distinct from other monetary policy tools because it directly affects regular people and the real economy. Other monetary policy tools, such as interest rate manipulation and quantitative easing, only directly impact banks. The term ‘helicopter money’ was coined by economist Milton Friedman in 1969 through a parable used to illustrate his theory on the effects of printing money. It has since then developed into a term for a serious policy proposal.

So what are the consequences of helicopter money?

Proponents of helicopter money believe it could be a potent tool to spur economic growth during crises when other monetary policy tools, like lowering interest rates and buying assets (quantitative easing), are unable to restart the economy. However, detractors say helicopter money could increase the money supply so drastically that it would drive substantial inflation. This inflation would offset the positive effects for citizens of receiving ‘free money’ – or worse, trigger a hyperinflation event.

So why do governments consider helicopter money as a policy tool? And how exactly could it impact inflation?

Why would a government use helicopter money?

Helicopter money is a useful tool because it allows governments to directly support regular citizens in times of distress. Conventional monetary policy tools aim to do this indirectly through banks, but over time they are becoming less effective. Following the 2020 pandemic crisis and subsequent lockdown, we saw many governments resorting to helicopter money ‘stimulus payments’. To better understand why governments are doing this today, we need to look at the other monetary interventions they tried.

Monetary policy tools are used by governments and central banks to attempt to moderate economic activity by changing the amount of money and credit available. Since almost all economic activity involves trading a good or service for money or credit, monetary policy decisions can have a huge impact on the entire economy: jobs, spending, asset prices, new business creation, and more.

Central bankers had two primary tools before helicopter money:

- Interest Rates

- Quantitative Easing

Tool #1: Interest Rates

The first tool, interest rates, refers to the central bank changing the cost of credit by buying government debt from banks in exchange for newly printed dollars. Lower rates make it cheaper to get a loan, or in other words: cheaper to get cash. This spurs borrowing, investment, and spending. Higher rates curb those activities and incentivize saving.

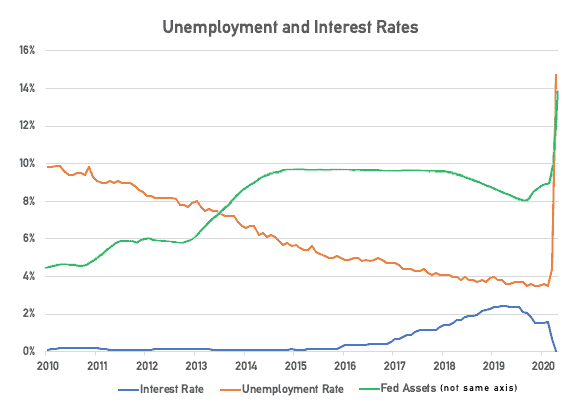

During the 2008 Great Financial Crisis, interest rates were cut to 0% in the US. In some countries, they were set negative. However, many economies were not growing steadily again as a result of low rates, even by 2014. So central bankers attempted the second tool.

Tool #2: Quantitative Easing

The second tool, quantitative easing (QE), is a fancy term for printing money and using it to buy debt (also known as issuing loans), thus ‘providing liquidity’ to the market. QE differs from interest rate manipulation in two ways. First, the central bank commits to a certain (large) size of asset purchase instead of an interest rate they want to maintain. Second, QE often involves the central bank buying the debt of private companies in order to perform a ‘bailout’.

During the 2020 COVID Financial Crisis, interest rates were quickly cut to 0% or went negative, and massive rounds of QE were done that dwarfed the 2008 reaction within days. Even this, however, was not enough to spur spending and growth in many economies, because the COVID shutdowns are so far and beyond more impactful than the triggers for past financial crises, like the 2007 housing crisis.

One month into the crisis, unemployment is reaching 15%-20% in the US, with most countries suffering a similar downturn, and no end is in sight. Many central banks and governments have moved on to the third tool.

Tool #3: Helicopter Money

The third tool is helicopter money – the central bank works with the government to distribute newly printed money directly to citizens. The first and second tools only affect banks and corporations, with the hope that those interventions ‘trickle down’ to all Americans. The third tool directly targets everyday citizens when desperate bids to buy assets (QE) and make credit free (via interest rates) are no longer affecting the larger economy.

Is helicopter money unique to the 2020 health crisis?

It may seem like the extraordinary circumstances of this pandemic are the reason central banks needed to move to this third tool of helicopter money.

However, it’s worth noting that financial luminaries who have studied the history of markets predicted the move to helicopter money long before this health crisis. Take Ray Dalio, founder of the largest hedge fund in the world and author of Principles: Life and Work, who wrote a very approachable and accurate breakdown of the coming move to Monetary Policy 3: helicopter money. He published this piece in May 2019, long before this health crisis.

Directly from the piece linked above:

Definition of Monetary Policy 3

Though most of us haven’t seen it in our lifetimes, it has existed in other lifetimes and other places. MP3 is a continuum of coordinated monetary and fiscal policies that vary who gets the money (private sector versus public sector) and how directly that printed money is provided (directly providing “helicopter money” to spenders versus more indirect means of financing spending).

Ray Dalio

What is even more impactful is the former Federal Reserve chairman, Ben Bernanke, clearly stated in 2016 that the only tool the Fed had left was helicopter money. After interest rates and quantitative easing are no longer effective, the Fed must resort to dropping money out of helicopters.

How does helicopter money impact inflation?

Helicopter money could have a much larger impact on what we commonly think of as inflation than the other two monetary policy tools of interest rates and quantitative easing for one key reason: helicopter money goes directly to the ‘real’ economy.

By ‘real’ economy, I mean the goods and services which the vast majority of people are purchasing regularly – food, gas, housing, medicine. The prices of these goods are measured together in what is called the Consumer Price Index (CPI). The Federal Reserve tracks the CPI to watch inflation.

“Inflation is always and everywhere a monetary phenomenon.”

Milton Friedman

When central banks lower interest rates and buy debt through quantitative easing programs, they are changing the amount of credit available to commercial banks, not to everyone. It is up to these banks, as private companies, to decide where that extra credit should be invested. Wherever they invest that credit, prices are likely to rise – or inflate.

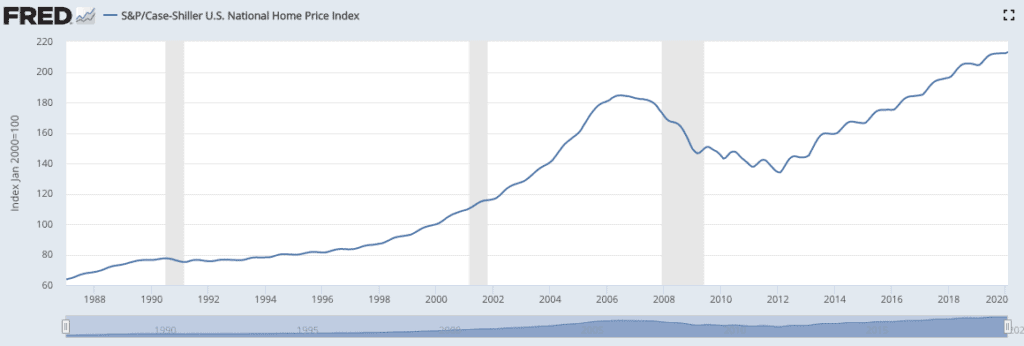

After 2008, many financial firms were bailed out (with QE) and the interest rate was dropped to 0%. With all this cheap credit, commercial banks could take on more risk and lend more. However, the banks did not put money into the hands of average citizens through home loans, small business loans, car loans, and other financial products offered to the average person.

Instead, they put all the new credit offered to them by central banks into ‘safe’ investments: large corporations, real estate, and wealthy clients. A deeper dive into this period between 2008 and 2020 can be found in my piece on inflation.

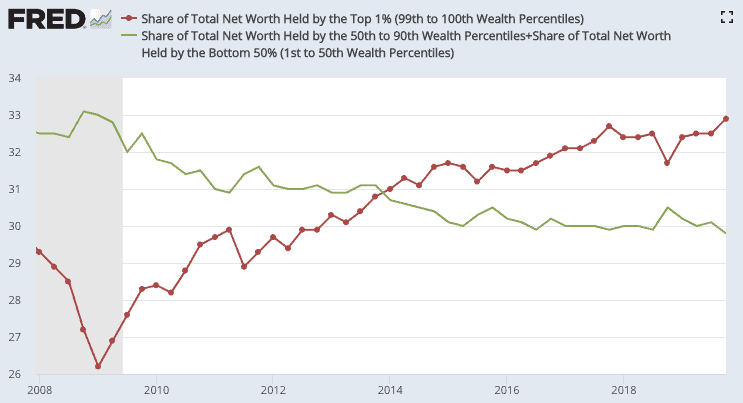

This led to a massive increase in the prices of stocks, fine art, coastal city real estate, and even wine – assets commonly owned and consumed by the rich. If this money had instead gone to the average citizen, we would have seen the goods and services that the average citizen spends on rise in prices.

This explains why we did not see ‘inflation’, as many central banks define it, following the massive money printing to bail out the 2008 financial crisis. The rich got richer, the average person stagnated in wealth, and the Consumer Price Index – which measures inflation – did not rise much.

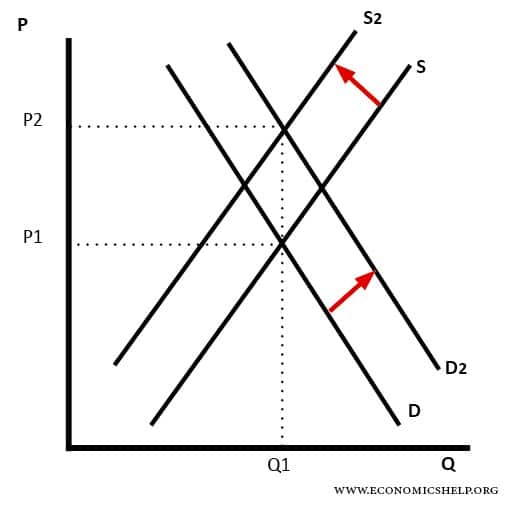

Helicopter money could drive inflation far more than previous monetary policy tools because the money and credit goes directly to the average citizen, the bottom 90%, and thus into the real economy. This extra money, like a monthly stipend, will drive up spending by citizens.

If supplies of goods remain steady or drop, possibly as a result of global supply chains locking up due to the pandemic, prices will be driven up by market forces. More demand as a result of helicopter money combined with decreased supply of goods is a recipe for a sharp rise in prices.

The government will try to combat this by instituting price controls and blaming greedy speculators for price rises. These efforts will end up causing shortages and rewarding political cronyism – if you know the right people, you can get the goods you want.

How do I know this? This exact scenario has played out in every monetary or economic collapse in history, from the Roman empire through to the Weimar Republic of pre-WWII Germany to the Soviet Union’s downfall.

How is helicopter money distributed?

In the United States, helicopter money is distributed through a partnership between the Federal Reserve bank, the US Treasury Department, and the Internal Revenue Service (IRS). The Federal Reserve creates new money and gives it to the US Treasury in return for government debt. The Treasury and the IRS then work to distribute that money to US citizens via checks and bank transfers.

How is helicopter money different than universal basic income?

The mechanics of helicopter money are very similar to the proposed mechanics of universal basic income schemes. The main difference is in the proposed duration of payments.

When the term ‘helicopter money’ is used today, proponents usually mean that this tool would be applied for a short time to handle a specific financial crisis. Universal basic income supposes that payments would continue indefinitely. Both, however, would realistically be funded primarily through Federal Reserve money creation rather than taxes. While helicopter money may only increase the money supply incrementally, if used once during a crisis, universal basic income would likely mean an ongoing, large-scale increase in the money supply.

Does helicopter money make sense?

Like many monetary policy tools which expand the money supply, helicopter money is a politically favorable solution to dealing with crises that has potential long-term effects. Like taking a Tylenol for a brain tumor, these tools address the pain without solving the underlying problem – continuous increases in the money supply that grow in size over time.