Bitcoin makes saving money cool – and practical – again. This article explains how and why.

What is Bitcoin?

Bitcoin has been called digital gold, a truth machine, a blockchain, a peer to peer network of nodes, an energy sink, and more. It is, in fact, all of these. However, these explanations are often so technical and dry, most people would rather watch grass grow. Most importantly, these explanations don’t show why Bitcoin matters for you or anyone else.

The iPod did not become a cultural sensation because Apple called it a “portable digital media device”. It took off because they called it “1,000 songs in your pocket.”

You don’t care what Bitcoin is. You care about what it can do for you.

Just like the internet, your car, your phone and many other devices and systems you use every day, you do not need to know what Bitcoin is or how it works to understand what it can do for you.

Why Bitcoin Matters

Bitcoin can protect an individual’s hard-earned money.

Bitcoin gained a lot of attention in 2017 and 2018 for its speculative use. Many people bought it hoping to get rich. The price skyrocketed and then crashed. This is not the first time Bitcoin has done this. However, Bitcoin has stayed around and steadily grown in price over 3-4 years spans.

Why has Bitcoin steadily grown? People are starting to understand how powerful Bitcoin is as a way to save money in a world where ‘money’ like dollars, euros, and other national currencies are designed to lose value.

This makes Bitcoin an excellent option for saving money for a few years or more. Bitcoin matters because it is an key alternative to saving your money in dollars, stocks, real estate, and even gold.

So forget for a minute about understanding blockchain, digital currency, cryptography, seed phrases, wallets, mining, and all those other arcane terms. We explain that in the next article if you are interested. For now, let’s talk about why people buy Bitcoin: the reason is simpler than you think.

Why do people buy Bitcoin?

Of course, everyone has their own reason for buying Bitcoin. One reason you probably hear often is because it goes up in value. People want to get rich. They hop in as speculators, go along for the ride, and most likely sell soon after they buy.

However, even when the price heads for the moon and comes crashing back down, many people end up staying after the crash. How do we know this? The number of active wallets per day, which is roughly akin to the number of Bitcoin users, keeps rising. Also, after every bubble in Bitcoin’s history, the price never comes back down to its price before the bubble. It always lands a bit higher. Bitcoin is climbing, and each massive speculative run brings in more and more people.

The number of active Bitcoin wallets is steadily growing

An “active address” means someone sent a Bitcoin transaction on that day. The chart below is on a logarithmic scale: the numbers on the y-axis increase exponentially.

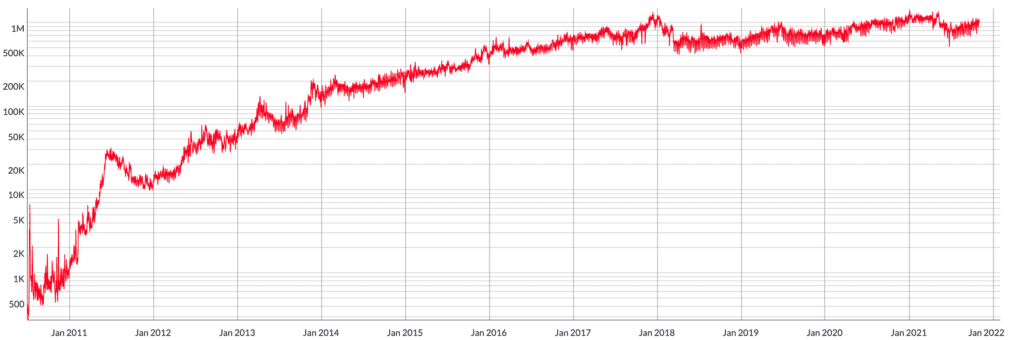

Bitcoin’s price is steadily climbing

We do see wild price fluctuations in the history of Bitcoin, but after every bubble, the price settles back down higher than before. This is Bitcoin’s price on a logarithmic scale: the price on the y-axis increases exponentially.

This shows people are sticking around: the demand for Bitcoin is increasing. If each massive price rise was just a bubble perpetrated by get-rich-quick scammers, the price would return to its pre-bubble level. This happened with tulips, but not with Bitcoin.

So why does Bitcoin’s price keep increasing? More people are holding Bitcoin for the long term – they are understanding what Bitcoin can do for their savings.

Why are people saving their money in Bitcoin instead of savings accounts, houses, stocks, or gold? Let’s look at those methods for saving and then compare them to Bitcoin.

Is your money safe in dollars, houses, stocks, or gold?

For many years, these were decent options for saving. However, the system that supports the value of all of these is in crisis.

Dollars

Dollars, and all other ‘fiat’ currencies produced by governments, are designed to lose value through inflation. Banks and the fiat monetary system cause inflation by constantly creating and distributing new money. When the US Federal Reserve announces a target rate of 2% inflation, this means they want your money to lose 2% of its value every year. Even with inflation at just 2%, your savings kept in dollars will lose half their value over a 40-year working life.

Reported inflation is low today, despite a growing “powder keg” that could lead to massive inflation. The more currency in circulation, the more powder in the keg.

Our governments filled the economy with currency to keep the banking system from failing after the 2008 financial crisis. Since then, most major central banks have set interest rates very low, which makes it cheaper for individuals and corporations to get loans. This means many individuals and corporations are taking out huge loans and using them to buy other assets like stocks, artwork, and real estate. All this lending means we are creating tons of new currency and putting it into circulation.

The 2020 COVID-19 stimulus bills are putting trillions more in the system. All of this currency creation eventually leads to inflation – a great loss in the value of the currency. The stimulus bills are so unprecedented in size that someone fashioned a meme to describe what’s going on.

An asset which governments can make more of to pay their bills? Not a good place to save money.

Houses

Homes were a decent way to save money over the last century. However, the housing crash in 2007 caused many homeowners to lose all their savings.

Today, houses are nearly unaffordable for the average person. One way to measure this is how many years of wages it takes the average person to earn the equivalent of the value of the average house. According to CityLab, a publication from Bloomberg covering cities, a family can afford a certain house if it costs under 2.6 years of that family’s household income. However, only the cheapest metro areas in the United States have median home prices at around 2.6 years of the median household’s income. In major cities like Denver and Los Angeles, the median home price is more than 5 years of the median household’s income.

If you can even afford a house, it may be a decent store of value. Until we experience another crash, and foreclosures take this asset from many homeowners.

Stocks

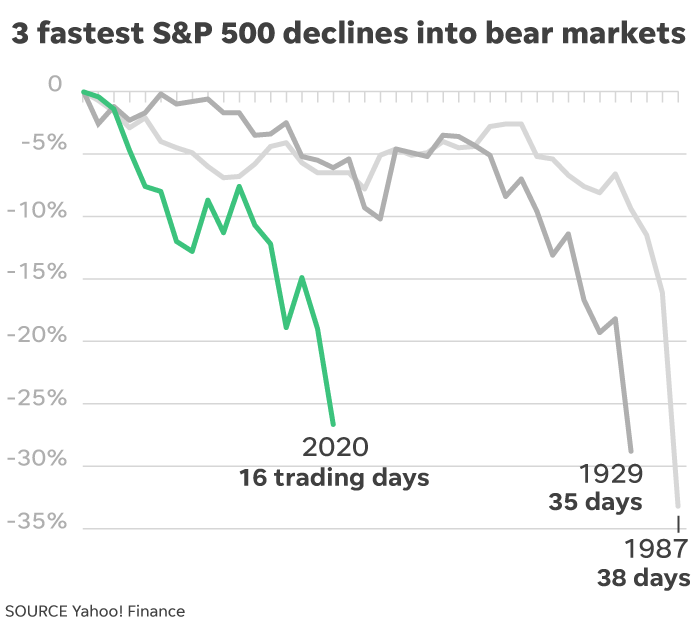

The stock market has also performed well in the past. However, slow and steady market increases happen in a boring, predictable world. We see less and less of this with every passing day. Following the acceleration of the coronavirus, we saw the fastest 25% drop in the US stock market in history – faster than the Great Depression.

Some choose to invest in bonds and other financial assets, but the ‘yields’ for these assets – the percent interest earned on the asset year over year – are steadily dropping. A growing number of assets even have negative yields, meaning it costs money to hold these assets! This is a big problem for anyone who is reliant on a pension. Plus, since stocks are denominated in fiat currencies like dollars and euros, inflation eats away at an investor’s returns.

The worst part is that the same economic crashes that cause mass layoffs and a tough job market also mean plummeting stock prices. Keeping your savings in stocks could mean losing both your savings and your job to a recession. Tough times may force you to sell your stocks at very low prices just to pay your bills.

That’s not a very secure way to save money.

Gold

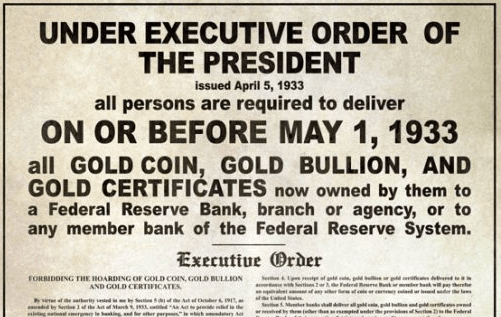

Gold has steadily increased in value for 5,000 years, usually dipping when the stock market promises stronger returns. The track record of gold’s value is solid. However, gold comes with other risks. Most people own gold on paper. They do not physically hold the gold, their bank does. This makes gold very susceptible to government seizure.

Why would a government seize gold, let alone a democratic country in the ‘free world’? It has happened before. In 1933 with Executive Order 6102, President Roosevelt ordered every American to sell their gold to the government in exchange for paper dollars. The government used the threat of imprisonment to amass gold. They knew gold was more respected as a store of value around the world than paper dollars.

If you hold your gold through a stock-trading app, you can bet that the government will seize it from you if they need it. Even if you keep physical gold, it is under threat of theft – by a criminal or your own government.

Your savings are not safe.

The growth of all the assets discussed above is dependent on our current political and economic system continuing as it has over the past 100 years. However, we are seeing huge cracks in this system today.

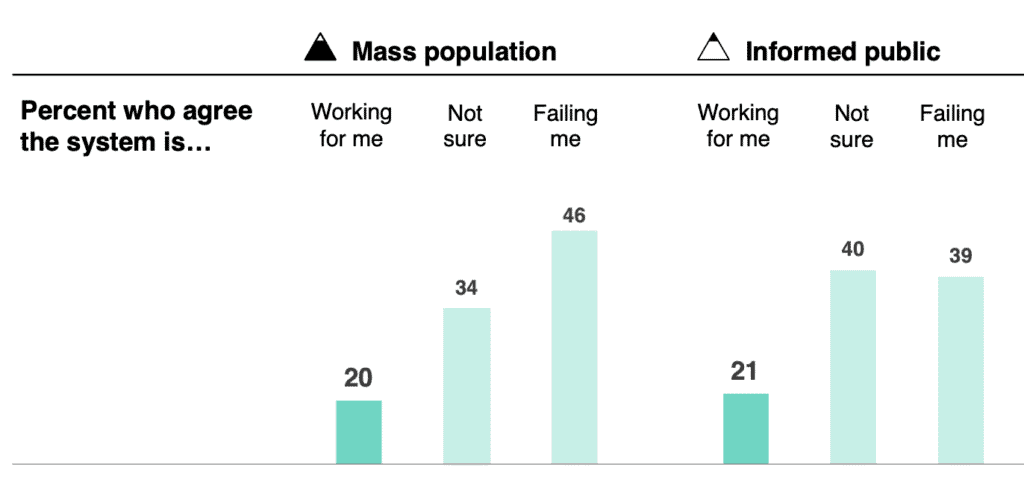

The system isn’t working well for most people anymore.

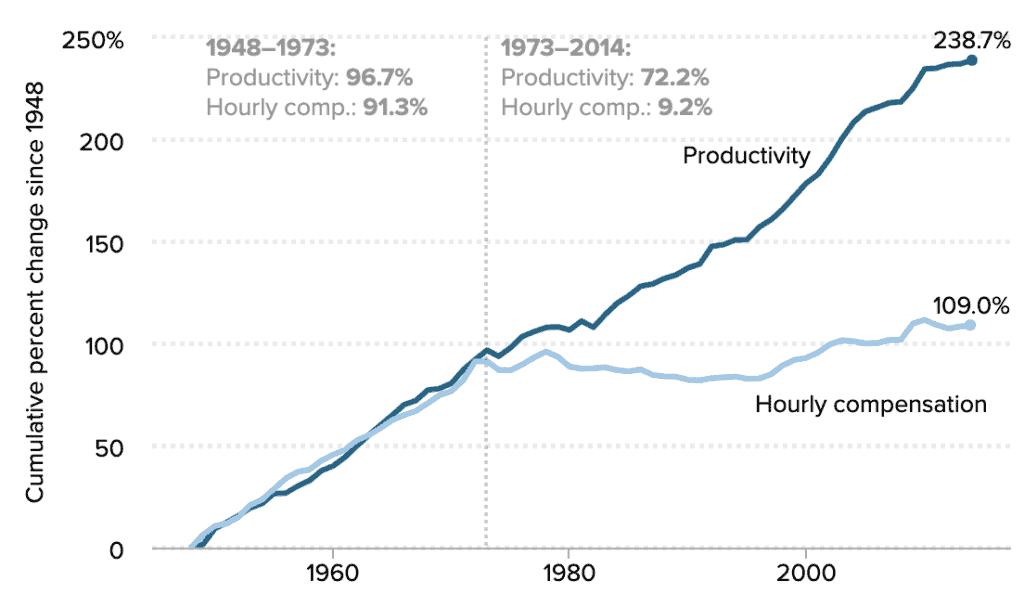

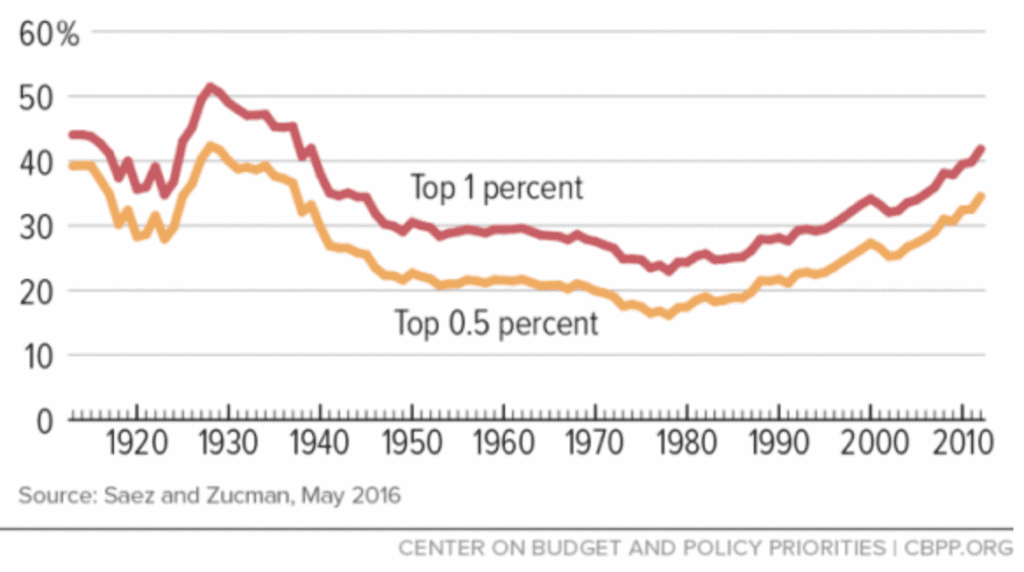

Since 1971, wages for the majority of US workers have not grown. The wealth held by the richest in society, on the other hand, stands at levels not seen in over 80 years. Meanwhile, people are trusting institutions like banks and governments less and less.

We see evidence of the system breaking down through political extremism around the world: the election of Trump and other extremist right-wing candidates, Brexit, the Occupy movement, the popularization of the concept of universal basic income, the term ‘socialism’ coming back into vogue. People on all parts of the political and social spectrum are sensing troubled times and reaching for increasingly radical solutions.

What’s better for saving than dollars, houses, and stocks?

In troubled times, all assets will experience wild price swings. Worse, many assets will be subject to seizure, taxation, draconian oversight and more as governments attempt to clean up the mess they’ve created by adopting fiat currencies.

Bitcoin has the most potential of any asset to hold its value through political and economic turmoil. Bitcoin matters in a world where institutions stop serving their constituents, and start to turn on them.

What makes Bitcoin different from other assets?

Bitcoin works so well as a method for saving because of its novel design, which makes it different from any other form of money that has existed before it. Bitcoin is a digital currency, the first and arguably only example of a currency that has a limited supply while running on an open, decentralized system. Governments tightly control the currencies we use today, like dollars and euros, and produce them to fund wars and debts. Bitcoin’s users – like you – control the Bitcoin protocol.

Bitcoin is an open system.

Anyone can choose to join the Bitcoin network and enforce the software protocol’s rules, which has led to a very decentralized system where no individual or entity can block a transaction, freeze funds, or steal from another person.

Today’s modern banking system differs greatly. A few banks are trusted to keep almost all currency, stocks, and other valuable items safe for their customers. To become a bank takes millions of dollars and incredible amounts of political clout. To run a Bitcoin node and “be your own bank” takes a few hundred dollars and an afternoon.

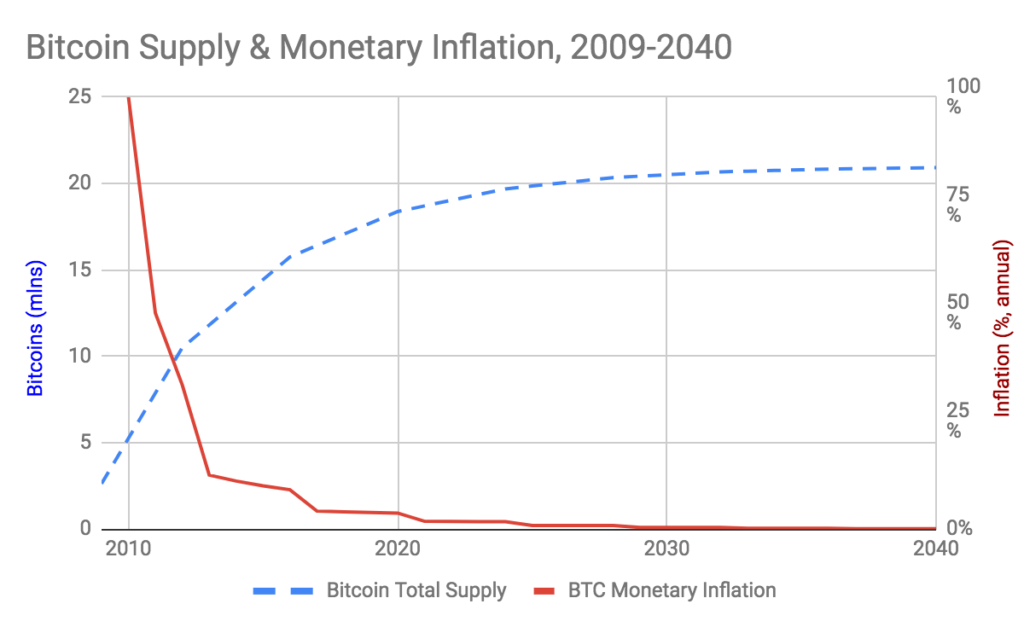

Bitcoin has a limited supply.

The open-source software protocol that governs the Bitcoin system limits the number of new bitcoins that can be created over time, with a cap at 21,000,000 total bitcoins. The currencies we use today, on the other hand, have an unlimited supply. History and present actions by central banks tell us that governments will always print more and more currency until the currency is worthless. All this printing causes inflation, which hurts wage earners and savers.

Fiat currencies are designed to go down in value over time. Every time a central banker says they are targeting a certain inflation rate, they are saying they want your money to lose a certain percentage of its value every year.

Bitcoin’s limited supply means it is designed to go up in value over time as demand for it increases.

Bitcoins have no counterparty.

Bitcoin is also different from assets like bonds, stocks, and houses, because it lacks a counterparty. Counterparties are other entities involved in the value of an asset that can devalue that asset or take it from you. If you have a mortgage on your house, the bank is a counterparty. The next time a large financial crash comes, the bank may take your house from you. Companies are quasi-counterparties to stocks and bonds, as they may begin to make bad decisions that affect their stock price or ‘default’ on their debt (not pay you or other creditors back). Bitcoin does not have these problems.

Bitcoin is accessible

Anyone with $5 and a cell phone can buy and hold a tiny bit of bitcoin. It’s important to know that you don’t need to buy an entire bitcoin. Bitcoins are divisible down to the 100 millionth unit, so you can buy a few dollars worth of Bitcoin at a time. Much easier than a home purchase or a single share of most stocks!

Bitcoin is highly portable

Anyone can send bitcoins around the world in minutes, regardless of borders, banks, and governments. It takes around 60 minutes for a transaction to fully “settle” so the receiver can be confident they own the bitcoins. To send other currencies around the world takes days or even months, and comes with high fees attached.

Some governments and journalists claim this freedom of travel afforded by Bitcoin aids criminals and terrorists. However, it is easier to trace a Bitcoin transaction than most transactions in dollars or euros, helping law enforcement track criminals.

Bitcoin is difficult to seize

Most of your assets are held by a bank or custodian, and those who trust them do so because they’ve never experienced an asset seizure in their lifetime. Even in the developed world, governments have a history of using crises as a means to coerce the public to trade away scarce assets for paper ‘fiat’ currency, which is promptly devalued.

Bitcoin’s design makes storage simple and private. You only need to store the password to your bitcoin ‘addresses’ (like bank accounts) to access your bitcoins from anywhere with an internet connection. You can store this password on a thumb drive or piece of paper. As a result, you can store millions of dollars worth of Bitcoin in your palm or in your head.

This makes Bitcoin difficult to seize, and difficult to spot – all of your property can be searched to no avail.

Bitcoin is for saving

Bitcoin is slowly proving to be the best option for saving money for the long term, especially given today’s economic climate. Owning even a little bit is an insurance policy that pays out if the world continues to go mad. The price of Bitcoin in dollars may fluctuate wildly within a year or two, but over 3+ years almost everyone sees similar or higher prices from when they bought.

Bitcoin Matters to Us All

Bitcoin as the ultimate savings account is all well and dandy, but does it help improve the world as a whole?

As you’ll start to understand by diving in to the other content on this site, many foundational pieces of our monetary system and economy are deeply broken today. However, those in charge are benefitting from these systems, so they are unlikely to change without a revolution. Bitcoin represents a peaceful overthrow, to fix the following at least:

- Fix money, which has served as an important tool for improving society over millennia.

- Bring sanity back to lending and borrowing, eliminating absurdities such as negative interest rates – where borrowers are paid to borrow.

- Drive investment in renewable energy and improve energy efficiency across the grid by serving as a ‘buyer-of-last-resort’ for all types of energy.

That is all you need to know to understand why you might want to buy Bitcoin. To start saving Bitcoin, try Swan Bitcoin or River Financial and sign up to earn Bitcoin back on your online shopping with Lolli. To keep your Bitcoin secure, consider using a hardware wallet.

If you want to better understand the mechanics of the Bitcoin protocol and how it ensures its incredible properties, read our post on how Bitcoin works.

How Bitcoin Works – from Mining to Hashing and Security

How can I learn more about Bitcoin?

This article gave you a basic understanding of why you should care about Bitcoin. If you want to learn more, I recommend these resources:

- Dear family, dear friends – A letter to all of you who still have no bitcoin.

- How does Bitcoin work? | Bitcoin.org

- What is Bitcoin? | Bitcoin Magazine

- What is Bitcoin?

- What is Bitcoin? | Nerdwallet

- Bitcoin Resources

- The Bitcoin Whitepaper ← published in 2008, this laid out the design for Bitcoin.

If you like my work, please share it with your friends and family. My goal is to provide everyone a window into economics and how it affects their lives.

Subscribe to email updates when new posts are published.

All content on WhatIsMoney.info is published in accordance with our Editorial Policy.