While most countries use their own currency within their borders, the US dollar still plays a huge role in the global markets. In this way, the dollar is important for all countries, and important to all peoples and societies given the importance of money to society. The dollar makes up 60% of all known central bank currency reserves, 40% of the world’s debt is denominated in dollars, and most physical US dollar banknotes are held outside of the United States.

Like any form of money, the dollar came to be used by every country over time because money is ultimately a network. Its value grows with how many people and nations will accept it. After WWII, the US used its favorable military and economic position to set the rules, and ever since has used active presence on the world stage to increase usage of the dollar.

When I say the dollar is used by every country, I don’t mean that everyone uses the dollar for payments – however, the dollar does play a major role in the financial system of almost all countries, and thereby almost all people in the world. Even when day to day transactions and even financing for businesses is done abroad, the dollar has a big influence on world affairs and trade. This is what people mean when they say the dollar is the world’s reserve currency.

How did the dollar get to this point, and where will it go from here? Is the dollar’s position guaranteed, and if not – what does the dollar and the United States depend on to keep this dominant position?

While this post mainly discusses how the dollar plays a significant role in global trade and affairs despite not being the local currency of other established economies, some foreign countries actually use the US dollar directly as their official currency. I’ve listed those below. Other countries link their currency to the value of the dollar in what’s known as a ‘peg’ – their governments and central banks buy and sell foreign currency as well as print their own currencies to maintain the value of their currency relative to the dollar. I’ve also listed those below.

Let’s get into the factors that make the US dollar the world’s reserve currency today.

1. The US Made the Rules at Bretton Woods

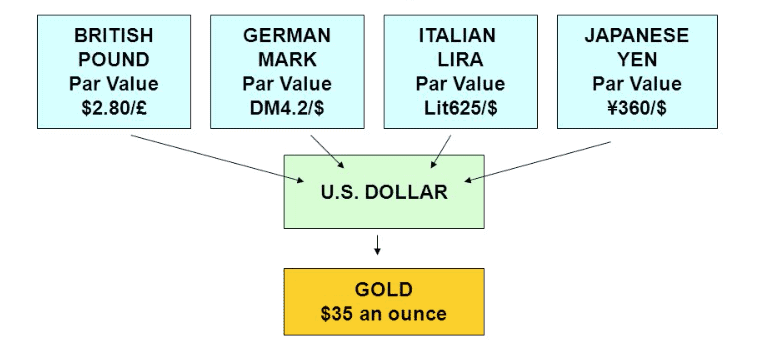

Near the end of World War II, delegates from the Allied nations met in Bretton Woods, New Hampshire to discuss the workings of a new international monetary system. Prior to this conference, most national currencies were tied to gold – they were essentially paper receipts representing a fixed amount of gold. After the conference, the Allied parties agreed to tie all currencies to the US dollar, which would in turn be tied to gold at a fixed rate of $35 per troy ounce of gold.

The desire for a coordinated monetary system was inspired by the economic failures in the aftermath of World War I. A breakdown in international trade and the gold standard between the two wars precipitated a global depression and led to isolationism and animosity – ultimately causing a second world war. Competitive devaluation of currencies by governments was common in the interwar period as a measure to boost exports. A cheaper currency relative to other currencies creates a temporary boon for exports, until prices have time to adjust, by making those exports comparatively cheaper to foreign buyers.

By tying all currencies to the US dollar and then to gold, this could be more easily averted. Every country had a strong incentive to keep up good political relations with the US, because they held all the gold backing the whole system.

The US was able to make the dollar the center of the monetary universe because of their strong position at the end of World War II. While the whole of Europe was decimated by a decade of bloody ‘total war’, the US was in a hopeful state climbing out of the Great Depression and physically intact – other than the Pearl Harbor military base. The dollar appeared legitimate on the world stage because it was tied to gold, a scarce commodity. In fact, the French and British begrudgingly agreed to the Bretton Woods system because they needed loans and access to the US market in order to restart their economies.

The Soviet representatives at Bretton Woods declined to ratify the agreements, foreshadowing US dominance through this financial system by stating that the institutions created by the Bretton Woods system – the World Bank and International Monetary Fund – were “branches of Wall Street.”

2. The US Government Owned Most of the Gold

Another major reason the US was able to shape the Bretton Woods system in their favor was their sizable gold holdings. At the time of the Bretton Woods conference, the US controlled two thirds of the world’s gold. The US gold holdings grew through World War II, as many European nations went into debt to finance war spending and transferred their gold to the United States.

This made a return to a pure gold standard system difficult – the European states would have to rebuild their economies without much gold and deeply saddled in debt. With the threat of Soviet incursion in Europe and the promise of further economic aid from the US, like the Marshall Plan, a US-led monetary system made sense to the Allies.

Even today, the US government holds the largest amount of gold compared to other nations – over 8000 tonnes of the yellow metal. However, the European nations together surpass the United States, with Germany, Italy, and France combined holding about the same amount as the US. Since 1971, the US dollar and all other major global currencies are no longer backed by gold in any way – making this hoarding a bit strange.

3. The US Exported Dollars for Reconstruction Aid

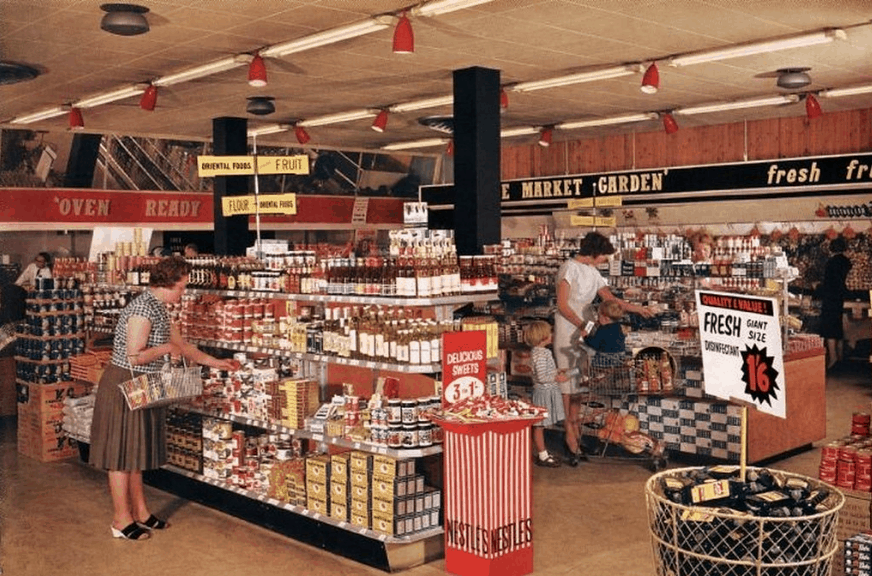

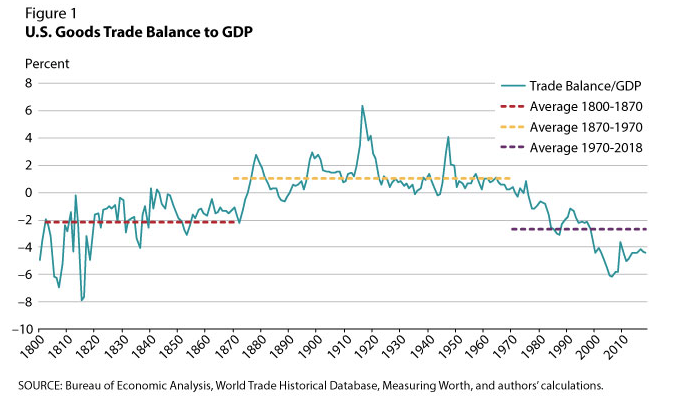

The US economy was of course strong coming out of World War II relative to all other nations in the world, but that strength increased throughout the second half of the 20th century. Europe and Japan enjoyed great growth through the 1950s and beyond, but the US was still able to maintain growth and dominance largely due to its ability to run trade deficits without damaging the value of the dollar. A strong US economy meant wealthy consumers who were able to buy goods from abroad.

After the war, a ravaged Europe needed to import food and necessities from the US, but this only increased the already sizable US reserves and stalled growth of industry in Europe. The US began a systemic campaign to reverse this flow, spurring global growth while also cementing the dollar as the center of the world monetary system. In the 1950s, the US ran a trade deficit, importing more value in goods than it exported, which led to net outflows of dollars. Of course, nations could redeem these dollars for gold, but many chose to hold dollars, which were useful in international trade and in order to pay back debts on loans from the United States.

Normally, a trade deficit like this is automatically corrected by the free market: high imports and low exports cause the monetary base (or gold reserves) of that country to shrink, reducing domestic prices, causing a fall in imports and rise in exports. Due to international demand for the dollar itself and the need to reconstruct Europe, the value of the dollar remained high even when the US imported heavily.

The Nixon Shock: Changing the Dollar Forever

In 1971, President Richard Nixon made a surprise announcement that would forever alter the trajectory of the world economy, and paradoxically further cement the US dollar in the world economy.

By the 1970s, the US was running dangerously low on gold reserves and stretching the backing of the dollar very far. While officially redeemable at a rate of $35 per ounce of gold, the dollar suffered heavy devaluation in the face of government deficits and borrowing. By 1971, gold at the US Treasury should have cost $200 per ounce.

To “defend the dollar against the speculators,” President Nixon severed the US dollar from its gold backing. That backing never returned, and all world currencies have been ‘free floating’ ever since, backed by nothing. Years of using the dollar as a reserve currency made the world accustomed to using dollars for trade, but the new lack of backing would invite competitors and possibly threaten US hegemony.

The US responded to this threat in 3 ways:

1. Mandating Oil Sells for Dollars

After Nixon ended the convertibility of dollars into gold, a massive reason for foreign people and governments to hold dollars disappeared. To keep the demand for dollars up, the US government needed a new plan.

What did they do? Nixon and several of his aides cleverly switched “dollars for gold” with “dollars for oil” through a system informally known as the petrodollar. The basic petrodollar deal looks like this: an oil-exporting nation gets military protection and aid from the US, and in return that country must only price their oil in US dollars and buy US debt securities (‘Treasuries’) with some of the profits of their oil sales.

This deal was most famously signed in 1974 with Saudi Arabia, then and now one of the foremost oil-producing nations in the world. Bloomberg broke the story over 40 years after the deal was made, revealing that the terms were kept secret up until that point.

This deal, and likely similar deals across the Middle East, created wide international demand for dollars. Oil is a vital commodity for growing nations, but is only found in a small number of places. Therefore, many nations need to import oil – and to do so, they need US dollars. This creates a constant demand for US dollars, and also makes countries likely to export goods to the US in order to earn dollars.

2. Making the US Consumer the World’s Consumer

The US consumer is a powerful force in the world economy. Responsible for 70% of US gross domestic product, consumer spending drives economic growth not only in the US but among major trading partners of the US, which rely on US consumers to buy their goods.

The US stands out among developed nations and regions with this spending rate, which is higher than another other developed nation and much higher than Japan’s 56% of GDP or China’s 39%. The huge US market means countries can grow quickly by marketing their goods to US consumers, but this comes at the cost of being dependent on the US consumer and government, as we’ll see in the next section.

The US consumer buying imports allows the US government and its citizens to purchase goods from abroad with a currency they can create at will. Imagine going to the car dealership and just printing the cash to buy the nicest car on the showroom floor – that’s essentially the power the US has. However, the US only has this power if foreign governments and corporations continue to demand US dollars and US government debt (which is turned into dollars when the Treasury Department sells it). Dollars are demanded if loans are denominated in dollars, oil is sold in dollars, and foreign governments want to hold dollars or US debt.

3. Selling US Government Debt to Continue Exporting Dollars

Now that we’ve covered the trade imbalance between the US and how that causes the US to ‘export dollars,’ we can turn our attention to how the US government sells debt to make these imbalances permanent.

To briefly summarize the government debt-selling scheme, all governments around the world sell debt in order to raise money. They are essentially saying “we will pay you back in a certain number of years, with regular interest payments, if you give us some amount of money or credit now.” This allows governments to spend more than they take in via taxes and revenues, but only sufficiently powerful countries can use this power with reckless abandon. The US is one such country, which sells its debt to financial institutions, foreign governments, and their own central bank (the Federal Reserve).

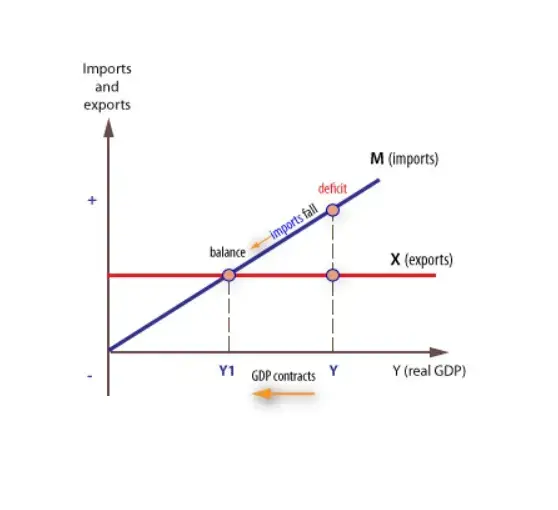

This debt plays a key role in international trade, because it can help balance trade flows. As discussed earlier, a trade deficit or surplus will naturally correct itself through currency values. If Country A exports more to Country B than it imports from them, demand for Country A’s own currency will increase since that currency is needed to purchase the goods and pay workers and suppliers in Country A. Country A’s currency will appreciate in value against Country B’s currency, making exports from Country A more expensive. This is a natural balancing force. In order for the two currencies to stay at the same relative value, there must be equal flows of capital and goods between the two countries.

Especially after the end of the Bretton Woods system in 1971, the United States began to increase its trade deficit in goods and services. This means the US is importing far more goods and services than it is exporting. This should mean that foreign currencies appreciate against the US dollar, making imports to the US more expensive and reducing the trade deficit.

However, foreign nations have adapted to this new reality where the US consumer buys up the world’s goods. In order to keep their products competitively priced in the US market, foreign nations like China and Japan buy US government debt with the US dollars they earn by exporting goods to the US. This balances the flow of goods, services, and capital, which means China’s currency, the yuan, remains at a stable relative value to the US dollar. This is what is meant by China “pegging” the yuan to the US dollar. The Chinese central bank, or People’s Bank of China, is promising to buy enough US Treasuries to keep the yuan pegged at a certain rate with the value of the dollar (around 7 yuan to 1 dollar). This ensures Chinese exports are still cheap and competitive in the US, even with China exporting far more than it imports.

As of April 2020, Japan and China together hold nearly 8% of outstanding US federal debt, and around 35% of US debt held by foreign governments. Buying this debt allows these countries to continue exporting large amounts of goods to the US, which fuels their economic growth. However, if these governments choose to sell US debt, they could create a situation where the US can no longer pay interest on the debt and will need to default. This could be devastating for the US economy and the US dollar.

3 Reasons the Dollar Could Fall

Due to the demand from overseas for US dollars and US government debt, the United States is able to keep a trade deficit – importing more than it exports – without causing the value of the dollar to drop. Economist Paul Samuelson, investor Warren Buffett, and former Federal Reserve chairman Paul Volcker all stated in 2005 (page 194) that this would cause a buildup in pressure that would eventually cause a ‘run on the US dollar’ (selling the dollar) – kicking off a serious global financial crisis.

What could kick off this run on the US dollar?

- Excessive printing of the US dollar – to fund social programs, bailouts, defense, or debt payments.

- The more dollars printed, the lower their value. If the US government prints dollars through further debt sales or financial alchemy like ‘Mint the Coin’ in order to pay back their existing debt, they devalue those repayments. Holders of US dollars and US Treasuries will lose wealth: American citizens, China, and Japan especially.

- This printing is accelerated by policies like helicopter money.

- America retreating from the world stage, canceling trade partnerships and reducing trade deficits.

- Trade partnerships like NAFTA and the Trans-Pacific Trade partnership ended under Trump’s term in the White House. Trade wars with China are now a constant and growing presence in economic life. A growing wave of popular support for protectionist policies that favor domestic production over the importation of goods, and the practical reasons for this highlighted by the COVID pandemic, are tides against continuing US trade deficits.

- Rising competition to the dollar from alternative currency options.

- Other global powers such as China, Russia, Brazil, and India are looking for a way out of the dollarized world, which gives the US incredible economic power over other nations. New development banks from these countries are also looking to make loans in local currencies, rather than dollars, but acknowledge that moving away from dollar-denominated debt would mean “[the US] would find a way to go after you.” Finally, non-governmental money like gold and Bitcoin could allow for a wholesale end to government meddling in money – and the conflicts, sanctions, and wars that come with it.

The unfortunate part of this situation is that a run on the dollar is not a question of ‘if’, but ‘when’. Like a drug addict, the longer the dollar bubble takes to pop, the harder the fall will be. The sooner the run occurs, the easier it will be to move past it and into a new monetary system with more sustainable characteristics.

If you like my work, please share it with your friends and family. My goal is to provide everyone a window into economics and how it affects their lives.

Subscribe to email updates when new posts are published.

All content on WhatIsMoney.info is published in accordance with our Editorial Policy.

Countries that use the US dollar as their primary currency

Some countries directly use the US dollar as their primary currency, instead of a local currency.

| U.S. Territory or Foreign Country | Population (2018) | Gross Domestic Product (2018) |

| United States of America | 318,636,000 | $20.5 Trillion |

| Ecuador | 17,084,360 | $108.4 Billion |

| Republic of El Salvador | 6,420,740 | $26.1 Billion |

| Republic of Zimbabwe | 14,439,020 | $31.0 Billion |

| Democratic Republic of Timor-Leste | 1,267,970 | $2.6 Billion |

| Federated States of Micronesia | 112,640 | $401.9 Million |

| Republic of Palau | 17,910 | $284 Million |

| Marshall Islands | 58,410 | $221.3 Million |

Countries that peg their currency to the dollar

This is only some of the countries which peg their currency to the dollar. Some nations, like China and Japan, have a more flexible system of following the value of the US dollar with their own currencies and are not included on this list.

| Country | Currency Name | Code | Peg Rate | Rate Since |

| Bahrain | Dollar | BHD | 0.376 | 2001 |

| Belize | Dollar | BZ$ | 2.00 | 1978 |

| Cuba | Convertible Peso | CUC | 1.000 | 2011 |

| Djibouti | Franc | DJF | 177.721 | 1973 |

| Eritrea | Nakfa | ERN | 15.000 | 2005 |

| Hong Kong | Dollar | HKD | 7.84 | 1998 |

| Jordan | Dinar | JOD | 0.71 | 1995 |

| Lebanon | Pound | LBP | 1507.5 | 1997 |

| Oman | Rial | OMR | 0.385 | 1986 |

| Panama | Balboa | PAB | 1.000 | 1904 |

| Qatar | Riyal | QAR | 3.64 | 2001 |

| Saudi Arabia | Riyal | SAR | 3.75 | 2003 |

| United Arab Emirates | Dirham | AED | 3.673 | 1997 |