The question of why we need Bitcoin is a common one today, but the answers usually leave most people tossing up their hands and declaring it’s either a Ponzi scheme or money for criminals. This conclusion does not do justice to how Bitcoin could transform the systemic unfairness and corruption baked into our current monetary system. One of those inequities in our system today results from the Cantillon Effect, a long-forgotten classical theory on how the distribution of money affects individual wealth.

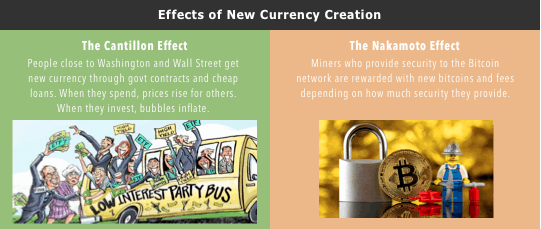

The Cantillon Effect describes how new money creation benefits those who receive the money first, at the expense of those furthest from the creation of new money. In today’s monetary system, banks and corporations are closest to new money while the middle class is furthest. Bitcoin fixes this by only giving new bitcoins to ‘miners’ who secure the protocol – a more fair distribution.

The Cantillon Effect is a way of charging an extra tax on anyone who works on a ‘sticky’ wage or holds primarily dollars as a share of their wealth. This tax transfers value to those who invest in financial assets or are preferred contractors of the government. Bitcoin divorces the creation of new money from politics, making it much fairer.

How the Cantillon Effect Works

When the supply of a type of money is increased, it makes sense that the new money needs to go into someone’s hands – but whose? Should it be rained down from the sky, given out in a lottery, or handed to special interest groups?

In our modern monetary system, this money is always (at least in name) a loan to the recipient, so they must pay it back at some point. Many economists incorrectly use the inflation fallacy to say that the fact this new money needs to be paid back, and will become someone else’s income, means the increase in the money supply is neutral.

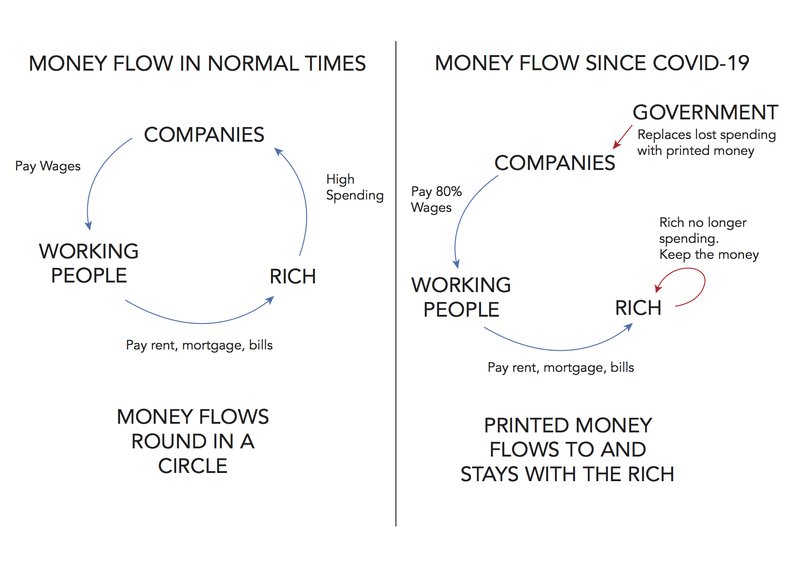

However, this analysis ignores how markets work. Where the new money goes first, and the way it spreads through the economy, have a big impact on peoples’ real wealth. Why? When the money supply is increased, prices do not increase immediately to reflect this fact. Instead, they slowly increase as markets react to the new total supply of money.

The first entities and people to receive newly created money are able to spend it before the market has reacted to any new money in the system. When they purchase items, they get low prices that do not yet reflect the fact that there is more money in circulation.

Once the new money has transacted a few times, prices begin to rise because there are more units of money being spent on the same number of goods and services. One ‘price’ in an economy is a wage or salary – this price will rise too, just like all others. However, this price rises more slowly as a result of the new money entering the system than say, the price of grocery staples.

As a result of this mismatch in timing of price rises, wage and salary earners must pay more for their daily necessities (like groceries) while receiving the same wage for some time. Wages adjust more slowly than food prices. This leads to a decline in the purchasing power of wage and salary earners.

This all stems simply from how new money enters the system. If new money entered the system only through loans directly from a central bank to peoples’ wages, wage earners would be able to spend it before prices rise, and would be better off.

How the distribution of money affects wealth was pointed about by Richard Cantillon in the 18th century, who watched these dynamics play out in England when the government printed money during his time.

How Bitcoin Solves Inequality from the Cantillon Effect

To understand how Bitcoin solves inequality, we have to compare how fiat currencies like the dollar are distributed today versus how new bitcoins are distributed.

Almost all fiat currency created today is first distributed to banks and the government. This is because the major commercial banks, like JP Morgan and Citi, are in turn supported by central banks like the Federal Reserve. Central banks have the ‘printing presses’ – meaning they can ‘print’ (or add digitally) an unlimited amount of their own fiat currencies into the world. They also set rules for commercial banks to encourage them to lend more or less dollars, which expands and contracts the total money supply.

Since banks and the government receive new money first, they decide who is second in line to get the benefits of the Cantillon Effect. This is where lobbyists come in, as well as the power of being well-connected to the financial elite. Lobbyists ensure their interests are benefitting from the Cantillon effect, and the super-rich as well as corporations are able to get loans from banks at great low interest rates.

The Bitcoin system eliminates the power of lobbyists and the advantages of knowing the right banker, and puts people on a much more equal footing. In Bitcoin, every ‘miner’ on the network has an equal shot at earning a reward of newly-created bitcoins every 10 minutes.

Anyone can become a miner by simply plugging a computer into a wall socket – far less laborious than lobbying elected representatives to grant you a government contract. Miners are spending a lot of money on electricity to compete for the reward, and they are providing a much-needed service to the Bitcoin system: security. Without miners, the Bitcoin system would not function.

In the US dollar system, we see political cronyism growing out of the Cantillon Effect. In the Bitcoin system, we see service providers (miners) being paid for their service with newly-created bitcoins.

Of course, the outcomes of the Cantillon Effect could be altered by politicians changing how new money enters the system. However, this doesn’t solve the underlying problem: someone benefits at someone else’s expense. The Bitcoin system is far more fair because it uses the Cantillon Effect to duly reward those who are providing a useful service for everyone else: securing the Bitcoin network.

Think of it this way: in the dollar system, someone is schmoozing the right politicians or bankers to get preferential treatment at everyone else’s expense. In the Bitcoin system, everyone is paying a little bit to protect their bank account from theft.

The Government’s Role in the Cantillon Effect

Federal governments around the world are one of the biggest beneficiaries of the Cantillon Effect, because they are able to receive loans from their nation’s central bank usually very easily. In the US, this is done when the US Treasury Department sells Treasury bonds and notes to the Federal Reserve bank. The Federal Reserve hands the Treasury Department a bunch of newly printed money, and the Treasury hands the Fed a piece of paper that says “we’ll pay you back at such and such time with some interest.” It’s a bit more complicated than that, but that describes the gist of it.

Since the money the federal government receives didn’t exist before, they are able to spend it before prices begin to rise from that new money entering circulation. This allows the federal government to spend on social programs, police, military, military equipment to arm nations like Saudi Arabia, even a ‘bridge to nowhere’ without having to do the politically unpopular: raise taxes to pay for it.

Instead of raising tax revenues to cover this spending, federal governments use the Cantillon Effect to transfer the purchasing power from middle-class wage and salary earners into the government’s treasury. In this way, inflation and the Cantillon Effect create a hidden tax on wage earners and money savers.

Protecting Yourself from the Cantillon Effect

Protecting your life from the Cantillon Effect is a tricky game to play. You can attempt to put yourself closer to the source of new money by competing for government contracts or working in finance. You can attempt to play the high-leverage games of stock market trading or real estate investment, but you are as likely to go broke as you are to protect yourself.

The easiest way to protect yourself from an unfair distribution of new money is to opt out of that monetary system altogether. Only the oldest generations alive today can remember a time when money meant something other than a piece of paper backed by the ‘full faith and credit’ of a government and military. We are so conditioned to think of money as a product of our government, but protecting ourselves from the Cantillon Effect requires looking at money through history – even just a century ago.

Money used to mean gold – a material that no government can magically create more of, and which requires a ton of effort to find and dig out of the ground. Bitcoin is very similar to gold in that nobody can magically create more of it, and it’s very hard to produce more by ‘mining’ it. However, Bitcoin also travels at the speed of the internet, enabling global commerce in ways gold simply cannot.

Protecting yourself from the Cantillon Effect requires opting out, as much as possible, from the unfair fiat currency systems by holding wealth in true money, like gold or Bitcoin. This is the most peaceful way to wind down the old system and usher in a new, fairer one.

If you like my work, please share it with your friends and family. My goal is to provide everyone a window into economics and how it affects their lives.

Subscribe to email updates when new posts are published.

All content on WhatIsMoney.info is published in accordance with our Editorial Policy.