For millennia, alchemists have searched for a way to create gold from cheap raw materials. Explorers searched for the ‘fountain of youth’. Economists and governments – they are always searching for the magic money tree.

A new school of economic thinkers and policymakers believe they’ve come a bit closer through the teachings of Modern Monetary Theory. This theory attempts to explain how our money actually works today. The MMT explanation is actually quite accurate, fitting with the monetary system we’ve had in place in most developed nations since 1971. However, MMT falls down right where it gets exciting: in the implication that their thinking leads to more freedom for governments to run bigger deficits, and in turn more prosperity for us all.

Unfortunately, history tells us that following the teachings of Modern Monetary Theory leads down a sour road in practice. Let’s get into it.

What Modern Monetary Theory Gets Right

Modern Monetary theory says a few things about currency and monetary dynamics that are quite different from traditional views. It says that if a government is ‘sovereign from a monetary standpoint’, we can throw out a lot of traditional thinking about economics and replace it with Modern Monetary Theory.

A government is sovereign from a monetary standpoint if:

- The government issues its own currency

- The government taxes its people in its own currency

- The government issues debt denominated in its own currency

- This means the government owes its own currency (which it can print more of) as payment for loans it takes out.

With these conditions satisfied, a government by definition cannot default on its own debt, because it can always print the currency it needs to pay back that debt.

| Traditional Views | Modern Monetary Theory |

| Governments must tax, then spend | Governments must spend, then tax |

| Currency is a shared, public good controlled by no one | Currency is a monopoly good produced by the government |

| The primary function of currency is as a medium of exchange | The primary function of a currency is as the sole payment method for that nation’s taxes |

| Government debt is paid back when the private sector, made more prosperous by government actions, owes more in taxes. Or the government raises taxes, fees, etc. | Government debt is paid by transferring currency from one account at the Fed to another |

The Order of Taxation and Spending

Like a household, traditional wisdom tells us you must make money before you can spend it. However, the advent of borrowing gives us more options. Instead of making money first, you can borrow it and then spend it. This is exactly what many governments do, most notably the US federal government.

Unfortunately, this little bit of insight is rather bland and meaningless when you consider that a government can either raise currency or borrow it. If it raises currency, we can say it is taxing then spending. If it borrows currency, we can say it’s spending and then taxing in order to pay back that debt. So in short, Modern Monetary Theory is right – but that doesn’t mean the traditional view is wrong. They are both correct, just different ways of looking at the same process of government spending.

While it would be incorrect—for reasons explored later—to argue that taxes “pay for” government spending, it is true that inability to impose and enforce tax liabilities will limit the amount of resources government can command.

Randall Wray – What if the Population Refuses to Accept the Domestic Currency?

Currency is a Monopoly Good

Throughout history, currency has traditionally arisen in various societies as the most ‘salable’ or ‘tradable’ good – the thing which the most people want. One of the unique and tricky aspects of currency is that ‘the thing which most people want’ does not need to have ‘utility’ in the classical sense – it does not need to be edible or provide protection from the rain. However, if other people want it, it can be used to buy food, homes, etc.

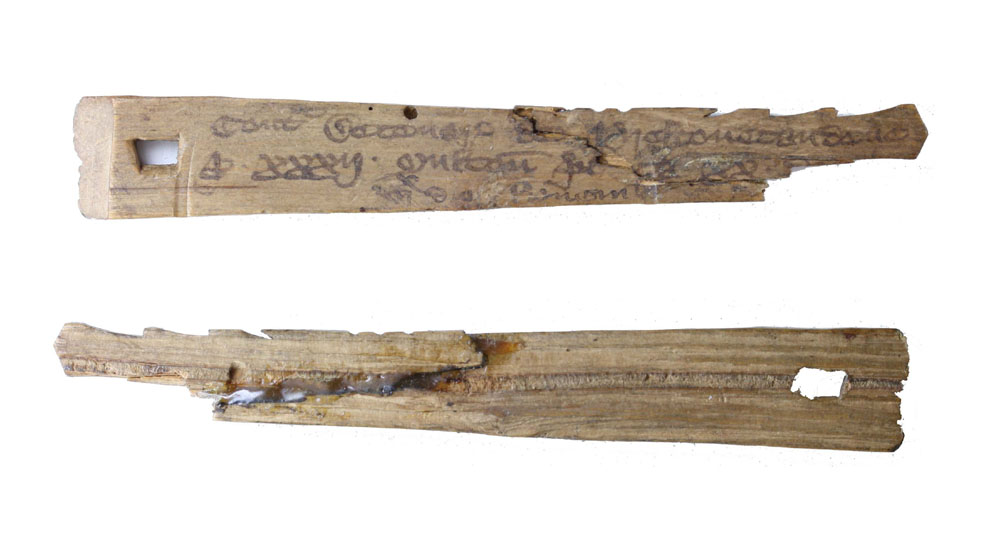

In many societies, precious metals served over long time spans as a form of money. Various ‘credit’ instruments like tally sticks also came about for certain periods. These forms of money were often co-opted by a local authority with ‘naked power’ – the ability to coerce people through force. This power, over time, often begins producing the ‘money’ themselves or otherwise regulates the use of it.

Today’s world is at the end of another incarnation of that monetary cycle in history. The United States government and other powerful states now have a monopoly on the production of money, and through the use of force to compel taxation, create a demand for the money they produce. Currency today, as we commonly think of it (dollars, euros, yen, etc), is definitely a monopoly product of governments. It was not always this way.

Currency is for Taxes

For MMT supporters, currency is tightly connected to taxation. While currency through most of history was a fairly decentralized system, with no single entity controlling production of the elements needed to create it, today’s currency systems are highly centralized. It is a main point of MMT that governments can and should influence the amount of currency in circulation through government spending and taxation.

Currency thus holds its value, even if it has zero demand by individuals for any private needs, because the government demands that currency as payment for taxes. Randall Wray, one of the founders of MMT thinking, puts it plainly in his primer on MMT:

We are now able to answer the question posed earlier: why would anyone accept government’s “fiat” currency? Because the government’s currency is the main (and usually the only) thing accepted by government in payment of taxes. To avoid the penalties imposed for non-payment of taxes (that could include prison), the taxpayer needs to get hold of the government’s currency.

Randall Wray – Taxes Drive Money

Government Debt Repayment is only an Accounting Issue

MMT proponents say that government debt repayment boils down simply to a transfer of numbers from one account at the central bank to another. This is true – government deficit spending creates a debt security and credits someone’s account with new currency. When that government debt comes due, the central bank just pays off the debt with newly created currency – moving numbers from the ‘securities accounts’ to the ‘reserve accounts’ (MMT White Paper).

However, that only explains how the accounting works for the debt. It does not attempt to address the value of that debt or the currency used to pay it back. The real world, unfortunately, respects real value more than accounting balance sheets.

When a government prints more currency and spends it in the economy, it doesn’t magically create value out of thin air – it only creates currency. So why is the government able to purchase goods and services with that currency? Where did the value of that currency come from, if they can’t print value?

The Dangers of Modern Monetary Theory

Modern Monetary Theory is correct in theory, but the implications of that theory are another story. Some of the biggest proponents of Modern Monetary Theory plainly state some of the alarming implications of their theory as pure fact when they explain their positions. We don’t even need to go to a spin doctor to understand why MMT thinking is not a good path forward.

Taxation Trap

Let’s consider a bakery and the mob for a moment. A mobster walks into the bakery and says, “would be a shame for this place to burn down.” He is using the threat of violence to extort the baker. He will most likely walk out of the bakery with money in hand, and come back to collect every month.

The baker is paying simply to avoid a punishment that the mobster invented: burning down her bakery. The baker may get a few benefits from the relationship – maybe some actual protection from a petty thief she’s dealing with – but we still see the core of this relationship as quite rotten. The mobster may provide some protection services, but by using threats of violence, he is able to extort a higher price than the baker would be willing to pay a guard for the same protection services.

When Randall Wray, one of the founders of MMT, says that a citizen will always demand their country’s currency because they need it to pay their taxes, and thus avoid prison time, he is plainly acknowledging that the government functions more like the mob than like a service provider. Demand for currency is created by taxes, and taxation is enforced through the threat of (and execution of) violent acts against citizens.

Randall makes the parallel even more clear with these two short passages from his MMT primer:

Note the asymmetry that is open to a sovereign: it imposes a liability on you so that you will accept its IOU [its currency]. It is a nice trick—and you can do it too, if you are king of your own little castle [with enough power to throw people in jail].

Randall Wray – Taxes Drive Money

The best kind of payment is an obligatory one—one that must be made to stay out of prison, or to avoid death by thirst. An obligatory payment that must be made in the sovereign’s own currency will guarantee a demand for that currency.

Randall Wray – What if the Population Refuses to Accept the Domestic Currency?

You may not feel so threatened by these statements if you feel that you already pay enough taxes, and it’s the billionaires who should be forced to pay more. However, remember that if your allies can use this to punish your enemies, your enemies can also use it to punish you. Once you cede this power to your government, you cede it to whoever may run that government in the future.

The MMT stance on taxation is also ironic in that even the leading economists defining this theory acknowledge that taxes are necessary to ‘soak up’ excess government spending and currency creation. So while a government’s budget might be unlimited, in order to keep interest rates and inflation down the government will need to raise taxes with spending increases – otherwise known as reducing the deficit or even balancing the budget.

Which is exactly what MMT proponents say we do not need to do anymore!

The Value of Government Debt and Currency

I mentioned earlier that a monetary sovereign can pay down its debt just by transferring currency between two accounts at its central bank. While this is technically true, by staying in the level of accounting balance sheets, MMT supporters fail to acknowledge the changing value of currency caused by deficit spending. So where does the buying power for government deficit spending, which creates government debt, come from?

The ugly truth is the value missing here – which fuels government deficit spending – comes from anyone holding cash or working on a salary that only adjusts periodically – possibly you. The loss of value in your bank account, in your salary, in your investments is a gain for the government. Funny enough, the number in your bank account, your salary, and your investment portfolio may be going up, while you are losing value! That’s exactly the point – you feel richer because your numbers are going up, but when you go to buy a house, invest in stocks, or start a business you find that prices for all these things are increasing. The value of that currency is falling – because the government is taking it.

MMT supporters are technically correct when they say that “a government that prints its own currency cannot default on debt denominated in its own currency.” However, they ignore the value of that currency – you would not be too pleased if you lent $100 to someone and received 100 pieces of toilet paper as eventual repayment.

Currency is not value – it is simply representative of value. Therefore, circulating new currency doesn’t create value, it simply takes value from all existing currency. Only increases in genuine productivity – people creating more things that others value – can create value and ‘grow the pie’.

Lessons of History

While Modern Monetary Theory’s controversial positions on the nature and role of money, taxation, and government spending are correct, I’ve explained how they are not actually so controversial. They are simply reframings of what we already know.

However, these reframings have opened the door for further legitimization of deep deficit spending. Even MMT supporters acknowledge that a government’s capacity to run deficits is not unlimited – as it either causes rising interest rates or price inflation. Taxation serves as the primary tool for removing money and liquidity from the economy to counteract these effects, and hey – it ironically also reduces deficits.

Unfortunately, the historical record for ongoing deficit spending and jobs guarantees by governments – even those which are monetary sovereigns – is not pretty. Many governments survive through short periods of deficit spending and monetary debasement (i.e. price inflation) during wartime or crises, but if they make deficit spending a habit, it often leads to complete downfall of the government and society – bringing innocent people with it.

Let’s go through some lessons of history.

Currency Debasement in Rome

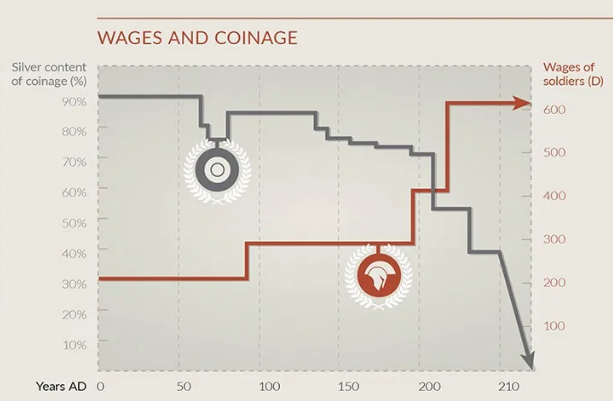

The Roman Empire at its peak was likely larger and more influential for the citizens of the world at that time than the American empire today. One of the Roman state’s biggest accomplishments was building a trade network that spanned around the entire Mediterranean Sea, and circulating a standardized coin of 4.5 grams of pure silver: the Denarius.

Denarius coins made their way to the Roman state’s coffers through taxes, military conquest, or payment for services. This meant the state’s spending was limited by this intake. Unfortunately, greedy emperors and bureaucrats invented a new way to spend more than they had – in fact, to do a form of ‘deficit spending’ just without any debt to pay back.

Instead of taking out loans, as governments do today, the Roman government debased their coinage by reducing the content of silver in each coin without telling anyone. For example, if the Roman government received 1 million Denarius coins in one month, they could smelt them down, mix in some cheap metals like nickel, and produce 1.5 million Denarius coins that they could spend as if they were pure silver. This is similar to any modern government today selling debt securities (like the US sells Treasuries) to their central bank in return for newly printed currency.

The effects of this deficit spending took time to play out. As the silver content of coinage dropped, meaning more coinage was created, wages slowly caught up to the monetary – and price – inflation.

When inflation began to take hold, debasing the savings of the Roman populace and the ability of merchants to accurately forecast costs and revenues, the Roman government responded with subsidized food programs to quell popular anger at price rises. Discounted grain became free grain, which Roman citizens began to expect and take for granted. Thus we have the origin of the moniker ‘entitlement programs’.

Of course, this food program cost the empire a lot of coinage – second only to military spending – which only exacerbated the debasement of Roman currency. When new silver imports from military conquest slowed down, Rome’s revenues declined, again adding to the widening deficit between government revenues and expenditures. The Romans tried higher taxes to solve the rampant inflation driven by deficit spending through monetary debasement. Today’s MMT supporters would champion this same move as the route to controlling inflation – however, for the Romans, it was too little too late. Citizens were accustomed to free food and programs – taxation represented the polar opposite of that.

Instead of solving the deficit and inflation, the Empire simply fell apart in the 3rd century AD, with possibly over 50 emperors over just a 50 year period. Political and economic turmoil preceded the beginning of the European ‘Dark Ages’.

Latin American Populist Public Spending

Latin American nations have a long history with MMT-style thinking. Usually, this type of thinking enters the public consciousness on the back of populist political parties or candidates who promise people new public works, wealth redistribution, and better economic opportunities for the common citizen.

These populist leaders often espouse similar goals for the economy and perspectives on markets as MMT supporters. For one, they believe the government should play a large and primary role in providing for people with low incomes – often through direct subsidies or wage controls – not unlike socialists. They also believe that monetary policy should promote growth by actively providing credit to the government – not just as a ‘lender of last resort’ to be used to get through crises. Their belief about inflation is most telling: here is Daniel Carbonetto, a Peruvian economist who led Alan Garcia’s populist policies in the 1980s, on this topic:

It is necessary to spend, even at the cost of a large fiscal deficit, because, when this deficit transfers public resources to increase consumption of the poorest, they demand more goods and this will bring about a reduction in unit costs. Thus the deficit is not inflationary.

Daniel Carbonetto, Peruvian economist who led Alan Garcia’s populist policies in the 1980s.

Similar mental gymnastics are used by MMT supporters to rationalize ongoing deficit spending and monetary debasement as non-inflationary. This statement can only be true if businesses increase their productivity at the rate that new money is printed. And when it takes mere seconds to create billions of dollars… you can see how the movement of real resources (productivity) is unlikely to catch up to the printing press.

For a full table comparing Latin American populist economic thinking to Modern Monetary Theory, see this article and search for “a number of key policies”.

So where did MMT thinking lead Latin American nations who tried it in the late 20th century? Initially, it leads to wage increases by fiat (ordered by the government) and massive public works programs financed via debt and monetary debasement. Things look rosy for a period of time of several years or more, depending on the country’s financial situation going in to the experiment and the global economy. Eventually, cracks begin to show – pressure on the currency to depreciate, random and large price increases.

This leads to more control from the populist government – like an air tank filling with pressure and springing leaks, unsustainable deficit spending fills the economy with currency and causes prices to rise and markets to break down. Price and wage controls are simply tape over those leaks – they may be useful if the government also reduces deficit spending, thus limiting the pressure in the tank. However, if the government continues to fill the economy with money, they are just allowing the tank to pressurize even further.

Eventually, inflation spirals out of control, and a grey market with true market prices that reflect heavy deficit spending that injected tons of new currency into the system begins to emerge. Price and wage ‘indexation’ begins, with the government more rapidly adjusting their controls in an attempt to mimic true market prices. Consumers all but stop using domestic currency because it loses value so fast, further exacerbating inflation.

In Latin American history, the populist governments were often replaced. If they are not, the economy suffers a total and brutal collapse back into barter, or citizens adopt a new currency (often a foreign one, like the US dollar).

This arc occurred in Argentina, Bolivia, Brazil, Chile, Ecuador, Nicaragua, Peru, and Venezuela – all governments that issue their own currency which they collect taxes in and denominate debt in (until the international community no longer wants their depreciating currency). For more detail on the specifics of Chile, Peru, and Venezuela’s experiences, open this article and search for “Three Populist Episodes in Latin America: Lessons for MMT Supporters”.

How America Dodged a Bullet

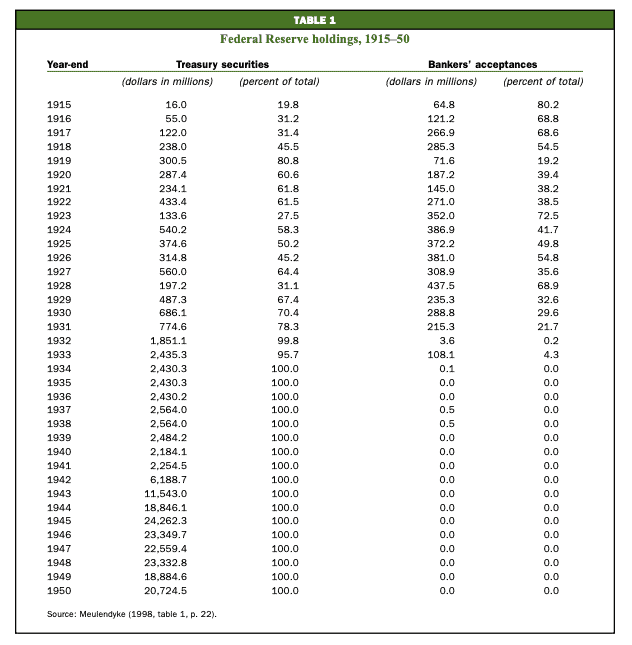

Given what we now know about the history of rampant deficit spending, we can see how close the post-1929 United States came to a similar fate as the empires and nations explored above. The bubble that preceded the Great Depression was fueled on the newly created Federal Reserve’s pumping of new currency into the economy by purchasing US government debt.

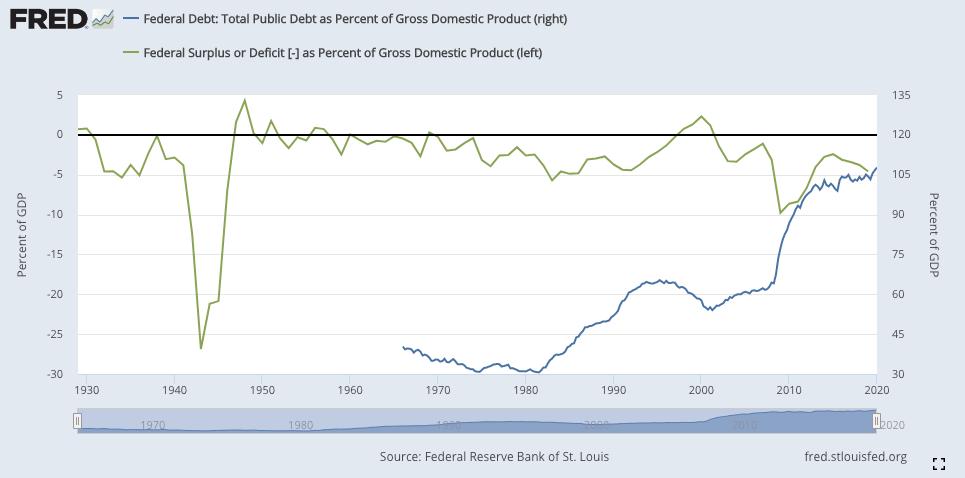

Instead of letting the debt bubble pop and unwind, the US government instead took on more debt in order to bail out banks and provide public works programs. The debt to GDP ratio climbed from 16% in 1929 to 40% in 1934.

However, the United States was lucky in that despite this and even higher debts during World War II, the war decimated so much productive capacity throughout the entire developed world except for the US, that just having intact businesses and land was enough to allow the US to lead the post-WWII world order. This allowed the US to steadily lower its debt-to-GDP until the 1970s, when Nixon ended the gold standard and ushered in the fiat money era – and the capacity for more deficit spending with it.

The Bottom Line

While MMT is a clever way to explain the monetary system we’ve lived under for the past 50 years, the implications pushed by its creators and supporters are dangerous to the long-term prosperity and freedom of nations and people.

MMT supporters fail to see economic realities or lessons of history through their accounting balance sheets and tautological statements about the functioning of government spending and taxation.

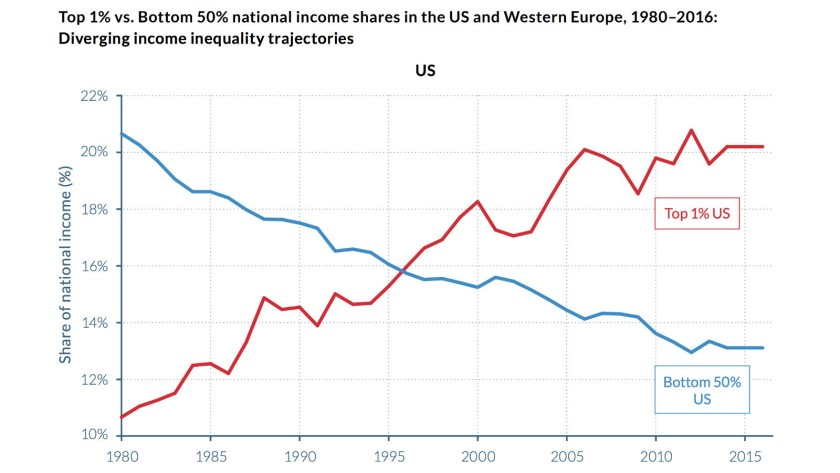

As we’ve seen throughout history, the endless pursuit of deficit spending to fund social programs and increased government control of resources ultimately ends in ruin. We can even see the progress of this in the United States over the past 50 years, since the beginning of the fiat money era and heavy deficit spending.

This heavy spending ends up benefiting some classes at the expense of others as a result of the Cantillon Effect and inflation. What happens is a massive rise in wealth inequality – those who understand the strong impact deficit spending has on the economy position themselves well for it and benefit. Those who don’t continue to work wage labor jobs and trust in the value of their currency – and suffer.

The result is either a monetary reset – where the currency and debts are washed away – revolution – where those who suffer from this system rise up and revolt against its beneficiaries – or war – where a rising power challenges the indebted current power. Throughout history, often all three of these occur at once or near to each other.

Individuals will attempt to save themselves from what this system is doing to society by opting out. They will put any wealth they have into assets that the government will have a hard time seizing or debasing – like physical gold and silver. Today, we also have Bitcoin – a vastly more accessible, portable, and unseizable version of gold and silver.

As governments gradually exert more control over the finances of individuals in order to soak up the liquidity they are pushing into the system at faster rates, they will push individuals to buy up gold, bitcoin, and other assets outside of the government’s fiat money system. Governments will try – as they have in the past – to collect higher taxes, eliminate tax evasion, and shame those who buy assets like gold and bitcoin as ‘speculators’ working to undermine national prosperity. They may even try new schemes like negative interest rates and Central Bank Digital Currencies.

While the government attacks the problems of deficit spending with more deficit spending, rationalizing their attempts with MMT-style arguments, they will only trade a market crash for hyperinflation. Deficit spending doesn’t solve anything – it just shifts the day of payment (or reckoning) later, while adding to the total cost. MMT fails to see this, using clever tautological statements and accounting truisms to cloud the minds of honest people trying to build a better world.

If you like my work, please share it with your friends and family. My goal is to provide everyone a window into economics and how it affects their lives.

Subscribe to email updates when new posts are published.

All content on WhatIsMoney.info is published in accordance with our Editorial Policy.