Modern Monetary Theory is famous for its assertion that money does grow on trees, at least for governments that issue their own currency and debt like the United States. The natural next question many have is, “why do we need to pay taxes?”

Modern Monetary Theory, or MMT, does not change economic laws like supply and demand – it only presents a new way to express the current state of our monetary system to the public. So unfortunately, taxes are still necessary – they just have new justifications when viewed through the lens of MMT.

To MMT supporters, taxes serve 3 main functions: controlling inflation by creating demand for the currency, redistributing wealth, and punishing or rewarding behavior. This is in contrast to traditional thinking on taxes, which considers revenue-maximization for the government an important factor.

The United States and a few other large, developed nations could implement this type of thinking around taxation. In this post, we will show the limits of taxation from an MMT perspective, and what that means for you as a citizen – with a focus on the situation in the United States.

Defining Monetary Sovereignty and MMT

Before we can get into the roles taxes play in Modern Monetary Theory, we need to establish what the theory says.

Essentially, MMT says that any government that is “sovereign” from a monetary standpoint is not restrained in its spending power, because it can print its own currency to finance any spending it wants to take on – including paying off past debts. This government cannot ‘default’ on its debt because it will always be able to pay back the debt by printing more currency. Of course that currency may be as valuable as toilet paper, but a monetary sovereign can still technically pay off any debt denominated in its own currency.

A government is sovereign from a monetary standpoint if it can do the following 3 things:

- The government issues its own currency

- The government taxes its people in its own currency

- The government issues debt denominated in its own currency

- This means other entities (countries, corporations, individuals) can lend to this government, but the government is only required to pay back those loans with their own currency. This is the meaning of ‘denominated’ – if you lend the US government $100 at a zero interest rate, they are obligated to pay you back 100 US dollars at a later date. However, they can just print those dollars if they are unable to earn them through taxes or services.

Viewed from this perspective, a government which is sovereign from a monetary standpoint does not need any revenue at all. This is the core of what MMT supporters mean when they say that governments that can print their own currency are different from households and individuals – they do not need to balance a checkbook.

So why do we need to pay taxes, if the government doesn’t need to earn revenue? This is where MMT supporters say our old ways of thinking are clouding our view of the promised land and its magic money tree.

The Conventional View on Taxes: Revenue

In conventional economic thinking, taxes are a way to create revenue for the government. The government must tax before it can spend on programs. This is normal, rational thinking that anyone who has balanced a budget will understand.

When formulating a new tax, then, It is important to consider the revenue that tax will raise. For instance, a tax on smoking that is aimed at reducing smoking has two considerations: maximizing revenue from the tax, and discouraging smoking. A tax that quadruples the price of a pack of cigarettes may bring in little revenue, stop many people from starting to smoke, and severely punish those who are already addicted.

When the government taxes, it brings in revenue that it can spend – just like a business or a household. This is still the conventional thinking on taxes, but it does not reflect reality since 1971, when the US went off the gold standard and kicked off the era of fiat currencies.

Growing federal government budget deficits since the 1970s are a clear example of the changed nature of our currency and its impact on our lives. The government can now spend with reckless abandon and use inflation and taxes to spread that cost to citizens. The government is increasingly happy just taking on more debt or printing the money they need to do what they want.

The Modern Monetary Theory View on Taxes: Demand and Policy

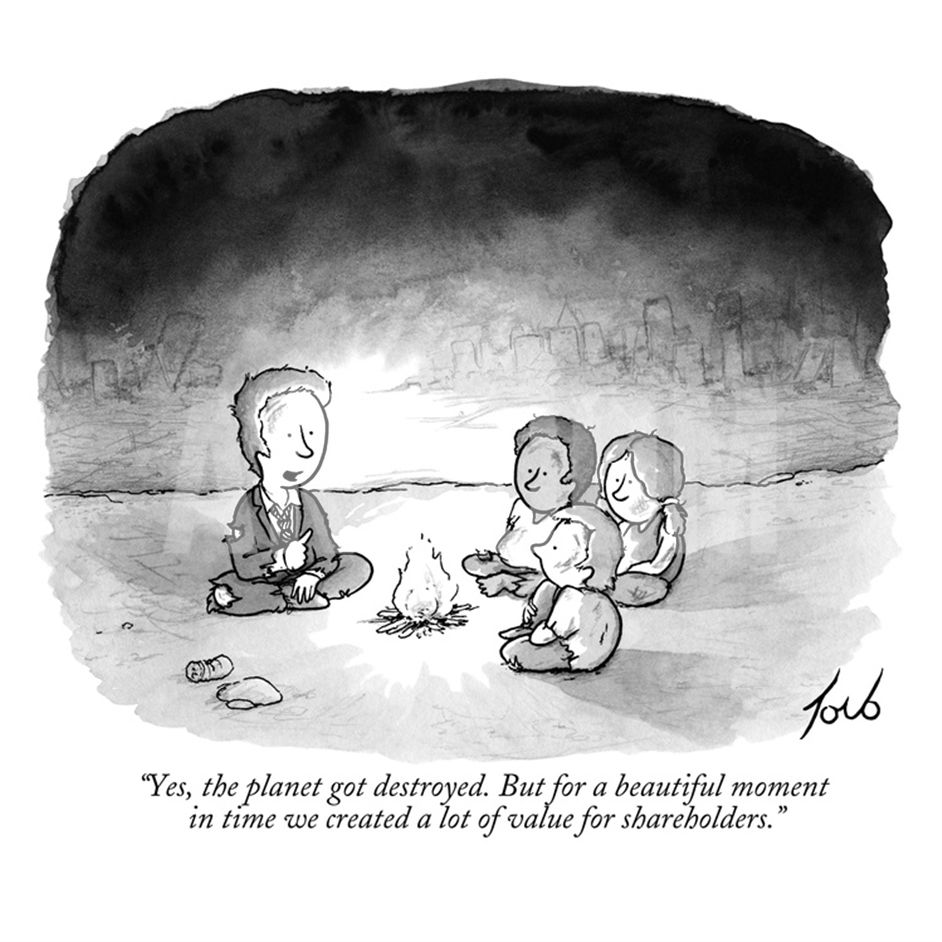

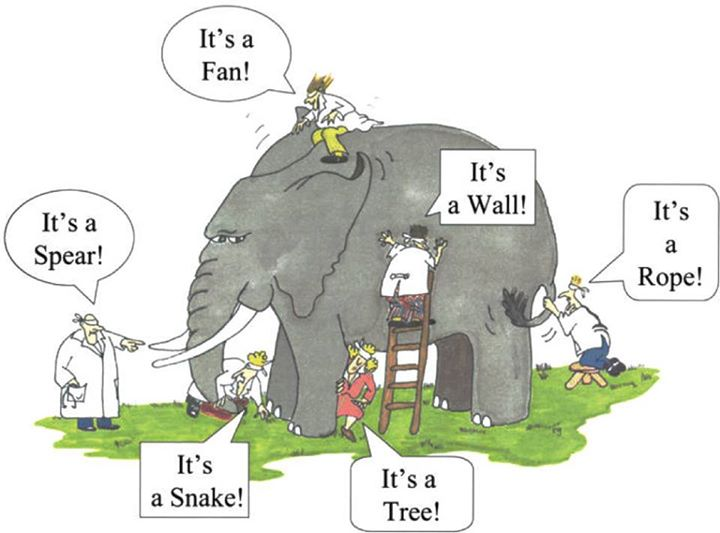

Modern Monetary Theory supporters say the government can continue to go deeper and deeper into debt infinitely, meaning that taxes are not required to finance their spending. The debt doesn’t matter, they say, because the government can always print the currency needed to pay it back. That reminds me of the below comic – while technically true that the government will always be able to print the currency they need to pay back their debts, that statement ignores the potential impacts on the value of that currency.

MMT proponents flip the math of taxation and spending on its head, saying:

Governments spend first and tax second.

This means governments create currency when they spend, and then tax that currency later to bring it out of circulation. This makes our currency more like a Chuck E Cheese token than a piece of gold. A Chuck E Cheese token only has value because the games at Chuck E Cheese will accept it as payment. Because of this, other kids may also accept Chuck E Cheese tokens from you as payment for a stick of gum. However, this does not mean the kids value Chuck E Cheese tokens intrinsically – because without Chuck E Cheese accepting the tokens as payment for games, the tokens would be worthless.

In this world, governments do not need to consider revenue maximization when creating a new tax. So if taxes are not for raising revenue, what are they for?

The Role of Taxation from the MMT Perspective

To MMT supporters, taxes serve 3 primary purposes:

1. Control inflation by driving demand for the currency

When the government prints more currency to fund its programs, it does not print value – it prints currency. This is a very important distinction to remember.

A currency cannot escape the law of supply and demand. The simple law of supply and demand states that an increase in supply puts downward pressure on the price (or ‘value’) of a good, while an increase in demand puts upward pressure on the price (or ‘value’) of that good. Printing more currency puts downward pressure on the value of all currency in circulation, which causes inflation in prices for all goods and services.

To counteract this, the government demands taxes be paid in that same currency, which increases demand for the currency and takes it out of circulation. The way the government enforces this demand for taxes, of course, is through threat of punishment – arrest, fines, and eventually imprisonment for those who do not pay all the taxes demanded of them. In short, it is this threat of punishment – and it’s legitimate follow-through – which gives the currency value. Taxes are only the middle step.

If some citizens view a tax as unfair, they may protest it by peacefully refusing to pay this tax. This protest poses a threat to the value of the currency, and therefore to the government’s ability to continue to print currency to fund their operations. The government then uses violence – through its police and legal system – to punish those who peacefully protest a certain tax.

Taxes in an MMT framework are used to stop prices from going up too fast (i.e. we are experiencing high inflation). The government imposes taxes on you to reduce the currency in circulation and bring price levels back down. From a macroeconomist’s point of view, this makes perfect sense. From the point of view of a young family with few assets and many bills to pay, this adds insult to injury.

The ironic part of this view of taxation is that in order for the government to print more money to fund more spending, it needs to levy more taxes to control inflation. The result is the same as our conventional view of government spending – that the government must raise tax revenue, then spend – just cloaked in new, more confusing language.

Currency cannot escape the law of supply and demand, so increased supply will either lead to a lower value for the currency (inflation) or government action to increase demand for the currency: which is known to us as ‘higher taxes’.

The Demand Spiral

It is worth mentioning here that holders of currency can also make predictions about the future which impact their decisions in the present. That is a very abstract statement, so let me make it more concrete:

Those who are holding US dollars, or an asset that earns a return in US dollars, can see when the US government creates more dollars to fund its spending. They know that this action pushes downward on the value of the dollar, so they will increasingly look to buy other assets with their US dollars – ones which will hold their value more steadfastly. This act of looking for other assets to trade for US dollars lowers demand for the dollar – people are selling the dollar to buy other assets. The US government’s problem of propping up demand for the dollar just got harder.

It is in this way that taxation and other methods by which the US props up demand for the dollar can escalate: slowly at first, then rapidly and exponentially.

2. Redistribute wealth

For MMT supporters, taxes are free from the need to raise revenue for the government, so they can focus on more ‘noble’ causes. One of these causes is wealth redistribution, which is gaining a lot of popular support in recent years.

Unfortunately, it is the very system of fiat currency we have today which is causing massive wealth and opportunity gaps through the Cantillon Effect of inflation. Using taxation to attempt to redistribute wealth without changing our monetary system is akin to giving a drug addict another hit, thinking it is curing their addiction because the symptoms of withdrawal subside.

Instead of fixing the core problem, redistribution of wealth through taxation simply gives the administration or party in power the ability to decide winners and losers. We are seeing this play out in politics today, with the Trump tax cuts benefitting the ultra-wealthy, and tax increases from the Left aimed at punishing those same ultra-wealthy.

The wealthy have natural advantages when it comes to beating taxes and inflation – they can hire lawyers and well-connected people to help them legally skirt taxes and influence tax law. They also have plenty of excess savings they can use to buy ‘inflation hedges’ like gold and Bitcoin. In contrast, wage earners who receive annual salary increases struggle to keep up with inflation and cannot afford the resources to legally avoid taxes. MMT’s view on taxes does not solve this problem – it exacerbates it by explicitly acknowledging that taxation and inflation are the two ways that governments can continue to print their currencies to fund spending.

3. Punish and reward behavior

The final role of taxes in an MMT system is to punish and reward behavior. While this is also a role of taxes more traditionally, it takes a more primary role in the eyes of MMT supporters because there is no longer a need to maximize revenue with a new tax.

MMT encourages governments to forget about revenue and solely consider what behaviors they want to punish and reward through taxation. When applied at a federal level, this means a small group of individuals in the federal government are able to use taxes to punish and reward hundreds of millions of citizens.

It is important to note that this thinking on taxes only applies at the federal level. State and local governments must still balance their budgets because they do not print their own currencies. However, state and local entities can receive ‘free money’ from the federal government’s printing press to help them balance their budgets.

Here’s an example of a potential new reality if the MMT view on taxes becomes prevalent: a handful of politicians in Congress could convince a simple majority of their co-workers, and the president, to pass a tax that triples the price of meat. A tax of 5% on meat would probably bring in far more revenue, but a 300% increase will lower meat sales drastically by making it unaffordable for many Americans. Nobody in Congress would need to be convinced that a 300% tax is effective at raising revenue, because that isn’t the point of the tax. They would only need to be convinced of the ideology that eating meat is bad, and that all Americans should think the same.

Taxation under MMT Thinking: Funding the Green New Deal

One example of how Modern Monetary Theory supporters view taxation can be seen in their discussion of funding for the Green New Deal. Many proponents of the Green New Deal or similar government spending programs say that we should tax the rich to pay for this spending – taking a traditional view of “tax then spend” government policy.

MMT supporters such as Stephanie Kelton and Warren Mosler, however, say the following:

Kelton and Mosler believe that taxing the wealthy does nothing for a big program like the Green New Deal: taxes don’t fund spending, after all, and wealth taxes won’t control inflation. “If you did an ambitious Green New Deal, two to three trillion [dollars] a year over ten years, and you tried to pay for it with a wealth tax, you’d get massive inflationary pressures,” Kelton told me. “You’ve removed all the income from people who aren’t going to spend it.” To remove cash from the monetary base, and thereby offset inflation, you have to tax the people who spend most of their income—the poor or middle classes.

Source: The New Yorker

The mental gymnastics here would make a chess master’s head spin. The Green New Deal, which is meant to spur growth in America, would require taxation on the poor and middle class – the very classes that are increasingly struggling over the last 50 years.

What MMT supporters are essentially saying is that the government doesn’t have to raise tax revenues in order to spend – but it does have to raise tax revenues to control the inflation that results from spending. So, taking out that middle part, we are left with: Governments have to raise tax revenues in order to spend.

And we are back at square one – conventional thinking on taxes!

Spending has Consequences – Taxes Fix Them

What we are left with in the discussion of taxes and MMT is a simple acknowledgement: government spending has consequences, and taxes fix them. Whether you tax first and spend second or spend first and tax second, the result is the same.

More government spending funded by currency printing will cause inflation, which can either be tolerated (benefitting the government and those who receive the currency first at the expense of everyone else) or controlled via inflation and other activities that generate demand for the currency.

This reveals that MMT thinking is not so different from what we have today – it is simply a different way of looking at the same simple laws of economics. These laws cannot be changed – only explained in different ways. MMT is just a different way of explaining the same thing.

MMT and its description of the role of taxes in our modern system is accurate – and that should be frightening. MMT is essentially acknowledging this role, and therefore nudging what is considered ‘acceptable policy’ more towards centralized bureaucracy at the federal level. A world where the federal government knows and publicly acknowledges it has an unlimited checking account is one where individuals, local, and state governments are incentivized to tow the line to whoever is in power at the federal level. Bending the ear of those who control the printing press and unfettered taxation means increasing their own power.

Conventional thinking around budgets and taxation put a restraint on governments, keeping them from morphing into authoritarianism. By needing to consider revenue-maximization when creating taxes, politicians are restrained from being able to project their own morals – or the morals of their most vocal or influential constituents – on all citizens.

While this may sound like a bad thing, it is in fact a good thing to anyone who has studied history. When politicians feel less and less restrictions on their ability to project their own morals on their citizens, they eventually do so. This ends up limiting freedoms and instituting a ‘tyranny of the masses’. If you are in the masses, it’s a great thing. But if you ever find yourself against the masses, in the 49.999%, this is a terrifying thing.