Banking is an often vilified and misunderstood business in the modern world. We see the bank bailouts of 2008 and the greed of flamboyant traders and wealthy investors as a societal scourge we must address and root out. While this may be true, it does not reflect the reality of banking, but more so the reality of central banking and our current monetary system. Let’s dive in.

Before we get into why banking is important to a healthy economy that helps prosperity grow for everyone, we need to understand exactly what banking is.

What is the role of a bank?

Today, many of us think of banks as a place where we store our money that gives us some convenient tools – digital payments, direct deposit from our employers, and maybe a credit card or investment account. These services seem very different from the side of banks we vilify – the ruthless business practices, shady investment deals, and complex financial products.

Banks throughout history, however, operated very differently from how they do today – and this limited their ability to engage in all the negative behavior we associate with banks today. Money is important to society, and banks once played a crucial and positive role.

Throughout history, banks served as an intermediary between savers and borrowers. Just like Uber matches your need for a ride to a driver, or Netflix recommends a show they think you’ll like, banks are a middleman that match money from savers to investment opportunities.

Why is this important? Here are 9 reasons.

1. Banks provide interest to savers

Growing savings requires investment expertise: making connections, evaluating companies and assets, and structuring deals. The average worker has some extra money they’d like to save and grow, but they don’t have the time to be an investment expert.

Banks pool this extra money from individuals as customer deposits and invest it using the bank’s expertise and connections. After the bank takes a cut for their time and effort, they give savers a a steady return through vehicles like the savings account.

Savers get a low risk and zero-time way to earn a return, helping them focus on their life instead of evaluating investments.

2. Banks provide loans to borrowers

When a business owner wants to expand, they often need to a lot of cash up front. Raising that cash can be a difficult process fraught with stops and starts, and it distracts from running the business. Banks – with their investing experience and processes – make it simple for business owners to access credit when they need it.

Business owners get a simple interface for raising necessary cash, helping them focus on building their business instead of fundraising.

3. Banks specialize in investing

Understanding business fundamentals and what separates good investments from bad ones is a skill, just like knowing how to design a kitchen, manage a team, or produce beautiful music.

Banks provide this skill as a service that benefits both savers and borrowers. Savers get a return with very low time and effort, while borrowers get cash so they can focus on growing their business. Banks fill a critical gap, benefitting everyone.

4. Banks can create money – for a time – through credit

Creating more money by extending credit is a nuanced topic. In a free banking system, extending credit by giving a loan effectively creates new ‘money’ in the economy, but when that loan is paid off, that new money is removed from circulation.

This money creation is best illustrated through diagrams. When Alice deposits her 100 gold coins in her bank account for safekeeping until she retires, the bank lends out, say, 90% of that gold to Bob who buys a new machine for his business with it. Carl, the producer of the machine, puts that money in his bank account, and the bank again lends out 90% of that money. You can see how this can go on many times over, and lead to what looks like an increase in the money supply.

In fact, much of the money in this system is just credit from the bank – there are still only 100 gold coins in existence. What is owed to the bank cancels out the bank deposits.

When these loans are paid back, the credit in circulation begins to shrink again. Eventually, we could return to a state where there is no extra credit circulating, and only 100 gold coins still in existence.

In today’s banking system, we use the US dollar and other ‘fiat’ currencies instead of scarce gold coins. This has led to a system where newly created dollars, euros, yen, etc are often left in circulation permanently through a complex web of monetary policy tools and deficit spending by governments.

This all ensures the amount of money and credit in circulation constantly grows. Instead of just helping to fund entrepreneurs, this system causes a constant transfer of wealth from those who save money to those who receive newly created money – this is known as the Cantillon Effect.

5. Banks protect your cash and assets

While financial institutions pay interest on deposits, they also provide a key service by holding assets safely on behalf of savers. Financial institutions have such scale that they can afford to invest in vaults and digital security infrastructure to protect assets.

6. Banks provide payment systems

This important role of banks is probably the one you are most familiar with today – facilitating payments. We take for granted that our employers and customers pay into our account, and we can spend out of it.

However, this role is not new. Throughout history, banks provided convenient payment methods for all manner of merchants. Consider the example in my piece on money, reposted here for convenience.

A city needs to pay farmers in the countryside for rice, and the farmers need to pay the city’s military for protection from barbarians. In this arrangement, gold flows in both directions: out to the countryside to pay for rice, and back into the city to pay for the military. To make these transactions easier, entrepreneurs created the concept of a bank. The bank stored gold in a secure vault and issued paper banknotes. Each note stated that the holder was owed a certain amount of gold from the bank. The holder of the banknote could retrieve their gold at any time by giving the banknote back to the bank.

Instead of needing to cart around gold or bags of cash, which is inconvenient and risky, banks can simply update their ledgers to note a change in ownership of money.

Digital payments were a step forward in this evolution of bank payment systems, and a huge enabler of an international economy. Since 2009, the role of banks in digital payments has become increasingly unnecessary, however, given the advent of Bitcoin.

This digital currency allows instant, international payments to be made without the need for banks. You can think of sending a bitcoin transaction as similar to teleporting a bag of gold coins or cash – very securely and instantly – to anyone else anywhere in the world (or even off it!). Banks are no longer necessary for digital payments.

7. Banks can offer insurance

In addition to offering loans and savings accounts, the special skillsets of banks make them well-suited to offer other financial products, like insurance. Offering insurance to a business, for example, requires understanding risk, managing capital, and analyzing that business.

As a result, insurance is a natural product that financial institutions can also offer. The bank earns a small premium from those they ensure, and pay out claims when necessary to businesses that suffer an insured loss.

8. Banks can offer financial advice

Another ancillary service financial institutions can offer is financial advice to their clients. Since banks and their employees specialize in making investments, they can help teach others how to think about and make investments for themselves. Savers who have some interest in learning how to invest can pay a fee to the bank for advice, essentially, on how and where to invest their savings. This can help guide savers towards better investments and temper their excitement or fear.

In speaking with many financial advisors, the key service offered by many of them is the simple sanity check. Most clients who are choosing their own investments with the help of an advisor simply want some increased peace of mind and second opinion when they are overly excited or fearful about an investment.

9. Banks can offer custody and trusteeship

Finally, banks can also offer services such as custody and trusteeship. While banks can hold your currency in their vaults, these vaults are often useful to store other things as well – family heirlooms, expensive watches, jewelry to name a few. For a fixed fee, the bank will store these things away for you and keep them secure in a safe deposit box.

Banks can also offer legal trustee services that ensure your savings are dealt with in whatever way you like in the event you pass away. If you keep your savings in your mattress, the first person who opens your door gets to make those decisions for you! A bank, on the other hand, often sells trust as a service by guaranteeing they will disburse your savings and assets in any way you specify.

Now that you have the 9 key reasons banking and banks are important, I want to address some related questions that you may have had while reading:

- Why am I not paid an interest rate on my bank account? Or why does it pay me so little?

- Why are banks so greedy and take so many risks with my money?

- How do we stop banks from being so greedy and taking so many risks?

The answer to all of these questions has less to do with banks themselves and more to do with our current monetary system, and central banks.

Banks today are on a bad path, led astray from their simple role as an intermediary between savers and borrowers. Here’s what’s wrong:

Banking is Broken Today

Banks are no longer effective intermediaries between savers and borrowers because of the money we all choose to use and deposit in banks.

We all use fiat money today – dollars, euros, yen, etc – which is not constrained in supply. The central banks and governments that produce each of these currencies can ‘print’ more of them any time they like.

Over time, a slow centralization of power has occurred – central banks, governments, and commercial banks became extremely close, and pushed us towards a system where the government and central bank (who can create fiat money out of thin air) are willing to provide deposits to banks just by printing more currency.

This means banks are no longer constrained by deposits. In a free banking system, a bank is naturally limited in the loans it can make and risks it can take by its level of deposits – if it loans out too much or loses money on bad investments, it can go belly up and bankrupt. However, the printing press of central banks and governments has been used time and time again to ensure that commercial banks, like JP Morgan and Citibank, cannot go bankrupt. This may sound like a good thing – your bank cannot lose your money – but it is in fact a very dangerous thing.

As private businesses, the banks love the printing press – they can take massive risks with investments, and if they do well, they keep the money. If those investments go bust, the government and central bank will bail them out by printing currency. All that newly printed currency debases the value of everyone else’s currency and savings while enriching the banks and investors that made very risky investments.

This creates a system which incentivizes banks to make riskier and wilder investment decisions. They don’t have to be smart about investing, they just have to make sure that if their investments fail, the government and central bank will bail them out. This makes their business a highly political one: banks today care less about making smart investment decisions than they do about cozying up to their regulators and signaling their virtue to the people. If they are the ‘good guys’ pushing for popular mainstream policies, they will get their bailouts when they need them.

All of this makes perfect business sense: the way to maximize profits in a system with central banks and bailouts is to befriend the printing press at the central bank and make the riskiest investments you can – because banks keep all of the profit, and suffer none of the losses.

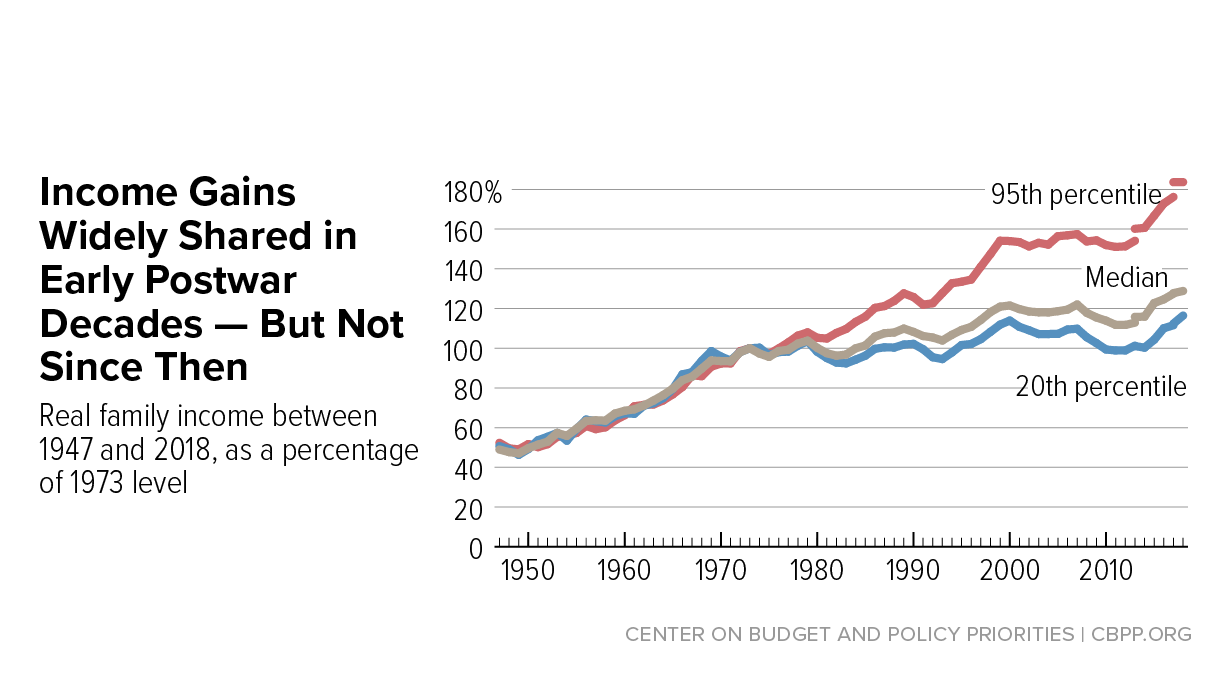

Who pays for the eventual losses of banks? The taxpayer and the wage earner simply trying to save money for retirement. In the US and Western Europe, you can see this clearly in the data since the dollar became a purely ‘fiat’ currency in 1971. The rich get richer, the poor struggle harder, and the middle class disappears.

If you like my work, please share it with your friends and family. My goal is to provide everyone a window into economics and how it affects their lives.

Subscribe to email updates when new posts are published.

All content on WhatIsMoney.info is published in accordance with our Editorial Policy.